Emergence of 5G Technology

The telecom api market is on the cusp of transformation with the emergence of 5G technology. This next-generation network promises to deliver unprecedented speed and connectivity, which in turn creates new opportunities for telecom APIs. With 5G, the potential for real-time data processing and low-latency communication opens avenues for innovative applications across various sectors, including augmented reality, autonomous vehicles, and smart infrastructure. The market is expected to see a surge in demand for APIs that can leverage 5G capabilities, facilitating enhanced user experiences and operational efficiencies. As telecom providers roll out 5G networks, the telecom api market is likely to evolve rapidly, adapting to the new technological landscape and meeting the demands of a more connected world.

Expansion of IoT Applications

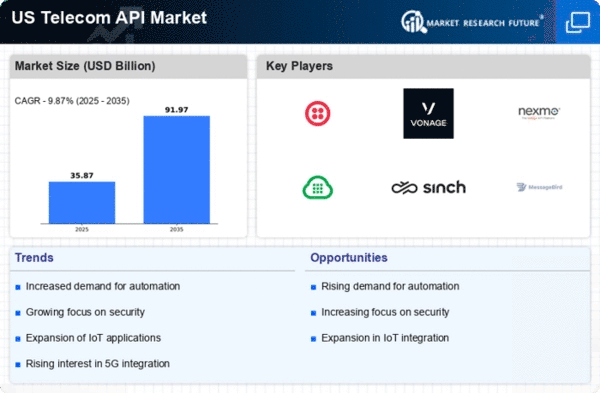

The telecom api market is witnessing a significant expansion driven by the proliferation of Internet of Things (IoT) applications. As more devices become interconnected, the need for APIs that can manage and facilitate communication between these devices is becoming increasingly critical. The market for IoT is projected to grow at a compound annual growth rate (CAGR) of 30% over the next five years, indicating a robust demand for telecom APIs that support IoT functionalities. These APIs enable seamless data exchange and control between devices, enhancing automation and efficiency in various sectors, including healthcare, transportation, and smart cities. As organizations seek to harness the potential of IoT, the telecom api market is likely to experience substantial growth, driven by the need for innovative solutions that cater to this expanding ecosystem.

Growing Adoption of Cloud Services

The telecom api market is experiencing a notable surge in the adoption of cloud services. As businesses increasingly migrate their operations to the cloud, the demand for telecom APIs that facilitate seamless integration and communication between cloud-based applications is rising. This trend is evidenced by a projected growth rate of approximately 25% in cloud service adoption over the next few years. Telecom APIs enable organizations to leverage cloud capabilities, enhancing their operational efficiency and scalability. Furthermore, the ability to access telecom services via cloud platforms allows for greater flexibility and cost-effectiveness, which is particularly appealing to small and medium-sized enterprises. As a result, the telecom api market is likely to benefit significantly from this shift towards cloud-based solutions, driving innovation and expanding service offerings.

Increased Focus on Customer Experience

In the telecom api market, there is an increasing emphasis on enhancing customer experience. Companies are recognizing that providing superior customer service is essential for retaining clients and gaining a competitive edge. Telecom APIs play a crucial role in this endeavor by enabling businesses to create personalized communication channels and streamline customer interactions. For instance, APIs can facilitate the integration of messaging services, allowing customers to reach support teams through their preferred platforms. This focus on customer experience is reflected in the market, with a reported increase in investments towards API development aimed at improving service delivery. As organizations strive to meet evolving customer expectations, the telecom api market is poised for growth, driven by innovations that prioritize user satisfaction.

Regulatory Compliance and Data Privacy

The telecom api market is increasingly influenced by regulatory compliance and data privacy concerns. With the rise of stringent regulations such as the California Consumer Privacy Act (CCPA), telecom companies are compelled to ensure that their APIs adhere to legal standards regarding data protection. This has led to a heightened demand for APIs that incorporate robust security features and compliance mechanisms. Companies are investing in developing APIs that not only facilitate communication but also safeguard user data, thereby building trust with consumers. The market is expected to see a growth of around 15% in demand for compliant telecom APIs as organizations prioritize data privacy. Consequently, the telecom api market is likely to evolve, focusing on solutions that align with regulatory requirements while maintaining functionality.