Expansion of 5G Infrastructure

The rollout of 5G infrastructure in Japan is a pivotal driver for the Telecom API Market. As telecom operators invest heavily in 5G networks, the demand for APIs that can leverage the enhanced capabilities of this technology is on the rise. 5G promises significantly faster data speeds and lower latency, which opens new avenues for innovative applications across various sectors, including healthcare, automotive, and entertainment. The telecom api market is likely to benefit from this expansion, with projections indicating a potential market growth of 25% by 2027. This growth is attributed to the increasing number of connected devices and the need for APIs that can facilitate real-time data exchange and communication. Consequently, telecom companies are focusing on developing APIs that can harness the full potential of 5G, thereby driving the overall market forward.

Emergence of Smart City Initiatives

The development of smart city initiatives in Japan is significantly impacting the Telecom API Market. As urban areas seek to enhance infrastructure and improve quality of life through technology, telecom APIs are essential for integrating various smart services, such as traffic management, energy efficiency, and public safety. The Japanese government has allocated substantial funding for smart city projects, with investments expected to reach ¥1 trillion by 2025. This influx of capital is likely to drive demand for telecom APIs that facilitate the interconnectivity of smart devices and systems. Consequently, the telecom api market is projected to grow by 22% as municipalities and private enterprises collaborate to implement innovative solutions. This trend underscores the critical role of telecom APIs in shaping the future of urban living and infrastructure development.

Rising Adoption of Artificial Intelligence

The integration of artificial intelligence (AI) into telecom services is emerging as a significant driver for the Telecom API Market in Japan. AI technologies are being utilized to enhance customer service, optimize network management, and improve operational efficiency. Telecom APIs play a crucial role in enabling AI applications by providing the necessary data and functionalities for machine learning algorithms. As businesses increasingly adopt AI-driven solutions, the demand for telecom APIs that support these technologies is expected to rise. Market analysts suggest that the telecom api market could see a growth rate of approximately 18% over the next few years, driven by the need for intelligent automation and data analytics. This trend reflects a broader shift towards digital transformation within the telecom sector, positioning APIs as vital components in the deployment of AI solutions.

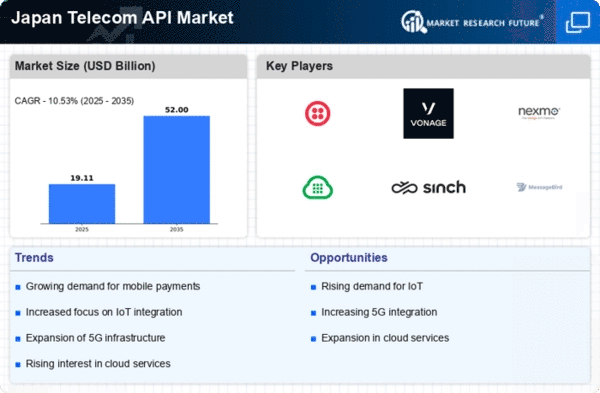

Growing Demand for Mobile Payment Solutions

The Telecom API Market in Japan experiences a notable surge in demand for mobile payment solutions. With the increasing adoption of smartphones and digital wallets, consumers are seeking seamless payment experiences. This trend is further supported by the Japanese government's push towards a cashless society, aiming for 40% of transactions to be digital by 2025. Telecom APIs facilitate secure and efficient payment processing, enabling businesses to integrate payment functionalities into their applications. As a result, the telecom api market is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of 15% over the next five years. This growth is indicative of the broader shift towards digital financial services, positioning telecom APIs as essential enablers in the evolving landscape of mobile commerce.

Increased Focus on Data Privacy Regulations

In Japan, the Telecom API Market is increasingly influenced by stringent data privacy regulations. The enactment of the Act on the Protection of Personal Information (APPI) has heightened the need for telecom companies to ensure compliance with data handling practices. As businesses leverage telecom APIs to access and process user data, the emphasis on privacy and security becomes paramount. Companies are investing in robust API management solutions to safeguard sensitive information, which is likely to drive growth in the telecom api market. The market is expected to witness a rise in demand for APIs that incorporate advanced security features, potentially leading to a 20% increase in API-related investments by 2026. This regulatory landscape not only shapes the operational strategies of telecom providers but also enhances consumer trust in digital services.