Government Initiatives and Support

Government initiatives play a pivotal role in shaping the Asia Pacific Smart Factory Market. Various countries in the region are implementing policies aimed at promoting smart manufacturing and digital transformation. For instance, initiatives such as tax incentives, grants, and funding for research and development are encouraging businesses to invest in smart technologies. In 2023, it was reported that government funding for smart manufacturing projects in Asia Pacific reached approximately USD 1 billion, reflecting a commitment to fostering innovation. These supportive measures are likely to accelerate the adoption of smart factory solutions, as companies seek to leverage government resources to enhance their operational capabilities and competitiveness.

Increased Emphasis on Sustainability

Sustainability is becoming a central theme in the Asia Pacific Smart Factory Market. As environmental concerns grow, manufacturers are increasingly adopting smart technologies to reduce their carbon footprint and enhance resource efficiency. The implementation of smart factory solutions can lead to significant reductions in energy consumption and waste generation. In 2025, it is estimated that the market for sustainable manufacturing technologies in Asia Pacific will reach USD 10 billion, reflecting a shift towards greener practices. This emphasis on sustainability not only aligns with regulatory requirements but also meets the expectations of consumers who are increasingly favoring environmentally responsible products. As a result, companies are likely to invest in smart factory technologies that support their sustainability goals.

Growing Focus on Supply Chain Resilience

The Asia Pacific Smart Factory Market is witnessing a growing focus on supply chain resilience. Recent disruptions have highlighted the vulnerabilities in traditional supply chains, prompting companies to adopt smart manufacturing solutions that enhance flexibility and responsiveness. By leveraging technologies such as IoT and blockchain, businesses can gain real-time visibility into their supply chains, enabling them to respond swiftly to changes in demand or disruptions. In 2025, it is anticipated that investments in supply chain technology will reach USD 15 billion in the region, indicating a strong commitment to building more resilient operations. This trend is likely to drive the adoption of smart factory solutions as companies seek to mitigate risks and enhance their competitive edge.

Rising Demand for Operational Efficiency

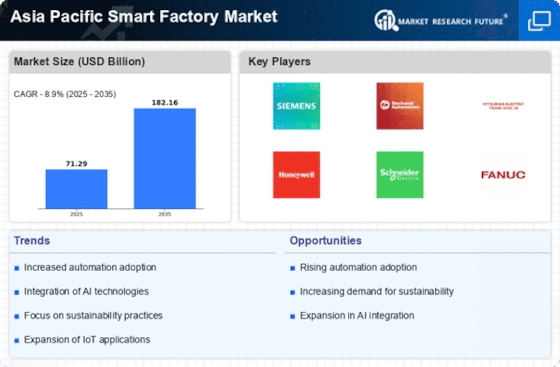

The Asia Pacific Smart Factory Market is experiencing a notable surge in demand for operational efficiency. Companies are increasingly recognizing the need to streamline processes and reduce waste, which is driving the adoption of smart factory technologies. According to recent data, organizations that implement smart manufacturing solutions can achieve efficiency improvements of up to 30%. This trend is particularly pronounced in sectors such as automotive and electronics, where competition is fierce. As businesses strive to enhance productivity and minimize costs, the integration of advanced technologies such as IoT and AI becomes essential. This shift not only optimizes production but also enhances supply chain management, thereby positioning companies favorably in the market.

Technological Advancements in Manufacturing

Technological advancements are a key driver of the Asia Pacific Smart Factory Market. Innovations in robotics, artificial intelligence, and machine learning are transforming traditional manufacturing processes. The integration of these technologies enables real-time data analysis and predictive maintenance, which can significantly reduce downtime and enhance productivity. In 2025, it is projected that the market for industrial robots in Asia Pacific will exceed USD 20 billion, underscoring the growing reliance on automation. As manufacturers increasingly adopt these cutting-edge technologies, they are likely to experience improved operational efficiency and reduced costs, further propelling the growth of the smart factory sector.