Rising Demand for Smart Manufacturing

The market experiences a notable surge in demand for smart manufacturing solutions. This trend is driven by the need for enhanced operational efficiency and productivity. As manufacturers increasingly adopt Industry 4.0 principles, the integration of advanced sensors becomes crucial. In 2025, the market is projected to reach approximately $20 billion, reflecting a compound annual growth rate (CAGR) of around 10%. This growth is indicative of the industry's shift towards automation and data-driven decision-making, where sensors play a pivotal role in monitoring and optimizing production processes. The market is thus positioned to benefit from this transition, as companies seek to leverage real-time data for improved performance.

Increased Focus on Safety and Compliance

Safety and compliance regulations significantly influence the factory automation-sensor market. As industries face stringent safety standards, the demand for sensors that ensure workplace safety is on the rise. These sensors are essential for monitoring environmental conditions, detecting hazardous materials, and ensuring compliance with regulations. In 2025, the market for safety sensors is expected to account for nearly 25% of the overall factory automation-sensor market. This emphasis on safety not only protects workers but also minimizes operational risks, thereby enhancing productivity. Consequently, manufacturers are increasingly investing in advanced sensor technologies to meet these regulatory requirements, further driving growth in the factory automation-sensor market.

Growing Adoption of Robotics in Manufacturing

The increasing adoption of robotics in manufacturing is a key driver for the factory automation-sensor market. As industries strive for higher efficiency and precision, the integration of robotic systems becomes essential. Sensors are integral to robotic applications, providing critical data for navigation, object detection, and task execution. In 2025, the robotics segment is anticipated to contribute significantly to the factory automation-sensor market, with estimates suggesting a market share of around 30%. This trend indicates a shift towards automated solutions that enhance productivity and reduce labor costs, thereby reinforcing the demand for advanced sensor technologies.

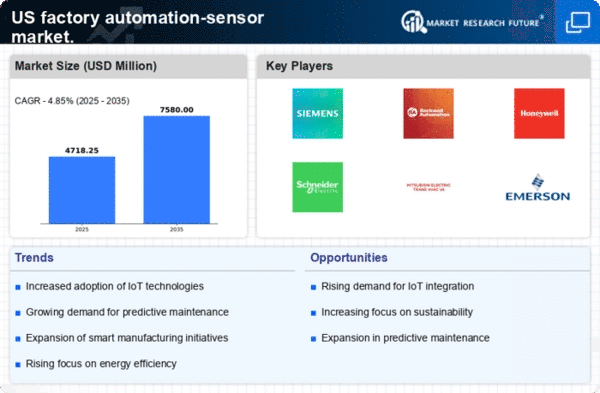

Expansion of Industrial Internet of Things (IIoT)

The expansion of the Industrial Internet of Things (IIoT) is transforming the factory automation-sensor market. IIoT facilitates seamless communication between machines, sensors, and systems, enabling real-time data exchange and analysis. This interconnectedness enhances operational efficiency and allows for better decision-making. By 2025, the IIoT segment is projected to account for over 40% of the factory automation-sensor market, driven by the increasing need for data-driven insights. As manufacturers embrace IIoT solutions, the demand for sophisticated sensors that can collect and transmit data will likely rise, further propelling growth in the factory automation-sensor market.

Technological Advancements in Sensor Capabilities

Technological advancements in sensor capabilities are reshaping the factory automation-sensor market. Innovations such as enhanced connectivity, miniaturization, and improved accuracy are enabling sensors to perform more complex tasks. For instance, the introduction of smart sensors equipped with artificial intelligence (AI) capabilities allows for predictive maintenance and real-time analytics. This evolution is expected to propel the market forward, with projections indicating a potential growth rate of 12% annually through 2025. As manufacturers seek to optimize their operations, the factory automation-sensor market stands to gain from these advancements, as they facilitate more efficient and reliable production processes.