Rising Demand for High-Quality Crops

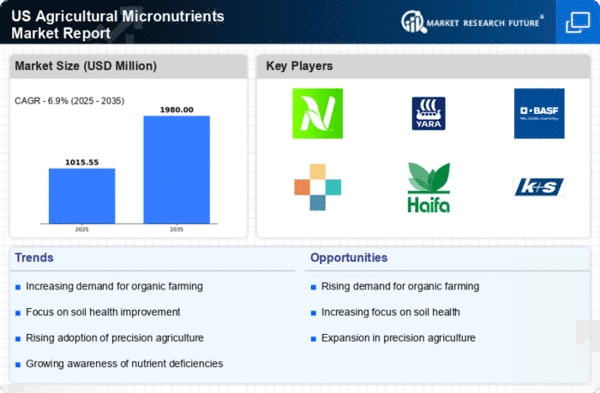

The agricultural micronutrients market is experiencing a surge in demand driven by the need for high-quality crops. Farmers are increasingly recognizing that micronutrients play a crucial role in enhancing crop yield and quality. For instance, crops enriched with essential micronutrients such as zinc and iron can lead to improved nutritional value, which is particularly important in the context of food security. According to recent data, the market for micronutrient fertilizers is projected to grow at a CAGR of approximately 7% over the next few years. This growth is indicative of a broader trend where agricultural practices are shifting towards more sustainable and nutrient-efficient methods, thereby propelling the agricultural micronutrients market forward.

Growing Awareness of Nutrient Deficiencies

There is a growing awareness among farmers and agricultural stakeholders regarding the detrimental effects of nutrient deficiencies on crop health. This awareness is fostering a proactive approach to soil management and nutrient application, thereby boosting the agricultural micronutrients market. Studies indicate that nearly 50% of soils in the US are deficient in key micronutrients, which can lead to reduced crop yields and lower quality produce. As a result, farmers are increasingly investing in micronutrient solutions to address these deficiencies. The agricultural micronutrients market is likely to benefit from this trend, as more stakeholders recognize the importance of balanced nutrition for sustainable agriculture.

Supportive Government Policies and Initiatives

Supportive government policies and initiatives are playing a pivotal role in shaping the agricultural micronutrients market. Various programs aimed at promoting sustainable agriculture and enhancing food security are encouraging farmers to adopt micronutrient-rich fertilizers. For instance, government subsidies for micronutrient applications can significantly lower the cost barrier for farmers, making it more feasible to incorporate these essential nutrients into their farming practices. Additionally, educational initiatives aimed at informing farmers about the benefits of micronutrients are gaining traction. As a result, the agricultural micronutrients market is likely to see increased participation from farmers who are motivated by both economic incentives and environmental stewardship.

Increased Focus on Sustainable Farming Practices

The agricultural micronutrients market is positively influenced by the increasing focus on sustainable farming practices. As environmental concerns rise, farmers are seeking ways to enhance soil health and reduce chemical inputs. Micronutrients are essential for maintaining soil fertility and promoting sustainable crop production. The adoption of organic farming methods, which often emphasize the use of natural micronutrient sources, is on the rise. According to recent estimates, the organic farming sector in the US is expected to grow by over 10% annually, further driving the demand for agricultural micronutrients. This shift towards sustainability is likely to reshape the market landscape.

Technological Advancements in Fertilizer Application

Technological innovations in fertilizer application are significantly impacting the agricultural micronutrients market. The advent of precision agriculture technologies, such as soil sensors and drone applications, allows for more targeted and efficient use of micronutrients. This not only optimizes crop production but also minimizes waste and environmental impact. As farmers adopt these advanced technologies, the demand for specialized micronutrient formulations is likely to increase. Reports suggest that the integration of technology in agriculture could enhance nutrient uptake efficiency by up to 30%, thereby driving growth in the agricultural micronutrients market. This trend reflects a broader movement towards data-driven farming practices.