Rising Surgical Procedures

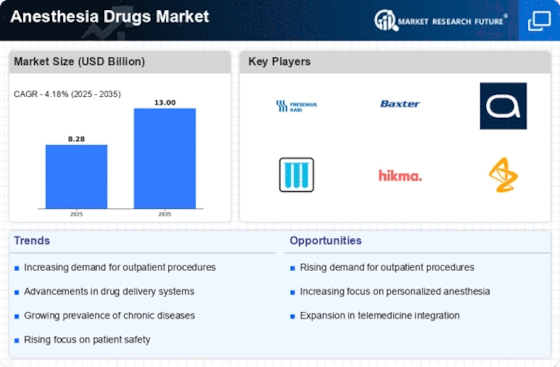

The increasing number of surgical procedures worldwide is a primary driver for the Anesthesia Drugs Market. As healthcare systems evolve, the demand for surgical interventions rises, leading to a corresponding need for effective anesthesia solutions. In 2025, it is estimated that the number of surgeries performed annually will exceed 300 million, necessitating a robust supply of anesthesia drugs. This surge is attributed to factors such as an aging population, advancements in surgical techniques, and a growing prevalence of chronic diseases. Consequently, the Anesthesia Drugs Market is poised for substantial growth as healthcare providers seek to ensure patient comfort and safety during these procedures.

Increase in Outpatient Surgeries

The rise in outpatient surgeries is a notable trend influencing the Anesthesia Drugs Market. As healthcare systems shift towards more efficient and cost-effective care models, outpatient procedures are becoming increasingly common. This trend is driven by advancements in surgical techniques and anesthesia practices that allow for quicker recovery times and reduced hospital stays. In 2025, it is projected that outpatient surgeries will account for over 70% of all surgical procedures, necessitating a tailored approach to anesthesia management. Consequently, the demand for specific anesthetic agents suitable for outpatient settings is expected to grow, further propelling the Anesthesia Drugs Market.

Growing Awareness of Pain Management

There is a growing awareness of the importance of effective pain management in surgical and non-surgical settings, which is propelling the Anesthesia Drugs Market. Patients and healthcare providers are increasingly recognizing the role of anesthesia in enhancing the overall surgical experience and recovery process. This awareness is leading to a rise in the use of regional anesthesia techniques, which are associated with reduced postoperative pain and quicker recovery times. As a result, the demand for specific anesthetic agents that cater to these techniques is expected to rise, thereby contributing to the growth of the Anesthesia Drugs Market.

Regulatory Support for Anesthesia Innovations

Regulatory bodies are increasingly supporting innovations in anesthesia practices, which is positively impacting the Anesthesia Drugs Market. Initiatives aimed at expediting the approval process for new anesthetic agents and technologies are fostering a more dynamic market environment. For example, the introduction of fast-track approval pathways for novel anesthetics encourages pharmaceutical companies to invest in research and development. This regulatory support not only enhances the availability of advanced anesthesia drugs but also stimulates competition within the market, ultimately benefiting healthcare providers and patients alike. As a result, the Anesthesia Drugs Market is likely to witness a surge in innovative products.

Technological Advancements in Anesthesia Delivery

Technological innovations in anesthesia delivery systems are significantly influencing the Anesthesia Drugs Market. The integration of advanced monitoring systems, automated drug delivery devices, and digital platforms enhances the precision and safety of anesthesia administration. For instance, the adoption of closed-loop anesthesia systems is gaining traction, allowing for real-time adjustments based on patient responses. This trend not only improves patient outcomes but also streamlines the workflow for anesthesiologists. As these technologies become more prevalent, the Anesthesia Drugs Market is likely to experience increased demand for compatible anesthetic agents, further driving market expansion.