Anesthesia Drugs Size

Anesthesia Drugs Market Growth Projections and Opportunities

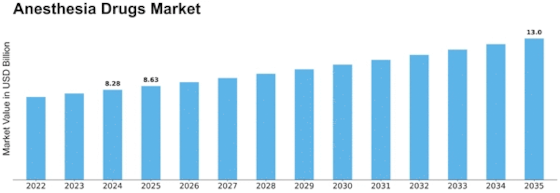

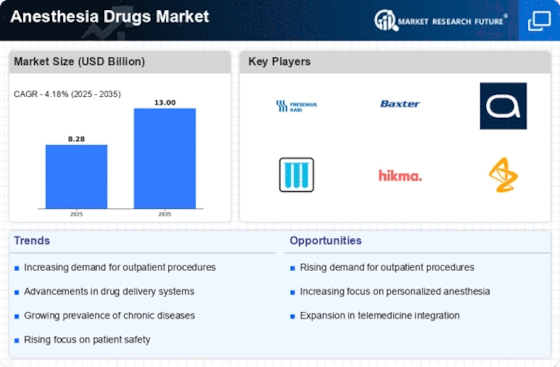

Anesthesia drugs market size is expected to reach USD 4.9 billion by 2030 at a CAGR of 3.7% during the forecast period. Many market factors affect the Anesthesia Drugs market dynamics collectively. One of these significant factors is the continued expansion in surgical procedures worldwide. As healthcare expands and technology improves, the number of operations increases, which in turn leads to demand for anesthesia drugs. Another reason why this market is expanding rapidly is that more people now suffer from chronic diseases that need surgery where anesthesia plays a critical role in ensuring patient’s safety and comfort during medical procedures. The pharmaceutical sector has always been central in shaping the Anesthesia Drugs market. Efforts are continually made towards research and development aimed at innovating and improving anesthetics with regard to their safety profile, duration, action time amongst others. The market is highly influenced by introducing new anesthetic agents and formulations as it greatly influences competition among pharmaceutical companies striving to offer up advanced and most reliable anesthetics for healthcare professionals. Regulatory influences are central when analyzing the Anesthesia Drugs market. Safety regulations on anesthesia drugs influence approval process for any new formulation. For pharmaceutical companies that want to introduce new drugs into the market or still maintain trust of healthcare professionals as well as patients regarding safety issues about administration of anesthesia will have to comply with regulatory guidelines.

Anesthesia Drugs market is affected by technological advances in medical devices and monitoring equipment. These include innovations made towards delivery systems for anesthesia, patient monitoring technologies along with drug administration equipments.These developments not only improve patients’ experiences but also provide healthcare professionals with tools for better delivery of anesthetic drugs thereby making it more precise hence improving patients’ outcomes.

Leave a Comment