Market Analysis

In-depth Analysis of Anesthesia Drugs Market Industry Landscape

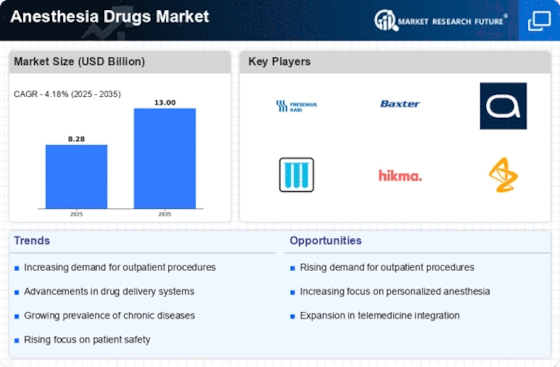

The dynamics of the Anesthesia Drugs market are influenced by a combination of factors that collectively shape the landscape of this critical healthcare segment. To begin with, one of the leading drivers behind this market is the rise in surgeries and other medical procedures around the world. The healthcare systems’ expansion requires more anesthesia drugs for safer surgery interventions throughout various nations. The high prevalence of chronic diseases that necessitate surgical operations has made the anesthesia drugs industry grow steadily.

The advancements in research and technology are key factors driving changes within this market. Numerous pharmaceutical companies are involved in developing improved and new anesthesia medications to enhance patient outcomes and make them safer. Novel formulations like inhalation agents, intravenous anesthetics and neuromuscular blocking agents have been introduced hence making the market dynamic. Such developments come about through continuous R&D which helps sustain growth through access to advanced anesthesia drugs for different medical purposes.

Influencing the dynamics of anesthesia drugs market are regulatory factors. For example, stringent regulations and health authorities’ oversight ensure that the anesthesia drugs used are safe and have desired outcomes to other related products. The competitive landscape in the industry is shaped by these regulatory demands by requiring comprehensive testing, clinical studies and strict adherence to quality standards. Therefore, it is important for pharmaceutical enterprises operating within anesthesia drugs sector to comply with all these regulatory requirements.

Economic considerations also play a significant role in shaping market dynamics. The cost of anaesthetic medication as well as healthcare services per se influences their adoption and utilization levels. Cost effectiveness of healthcare services affects both patients and providers influencing their decision-making while buying anaesthetics. In addition, affordable yet high-quality anaesthesia medications should be available on the market especially in resource-poor settings where there may be no alternative. Moreover, population aging which is a global demographical trend has major implications on the anesthesia drugs market. An increasing elderly population globally means that more people will require surgeries because old age comes with various chronic illnesses thus leading to increased demand for anesthetic medication during surgical procedures. This indicates that strategies for healthcare providers as well as pharmaceutical companies need some adjustment to suit this group such emphasizing tailored solutions regarding geriatric-oriented study on anesthesia.

Leave a Comment