Market Share

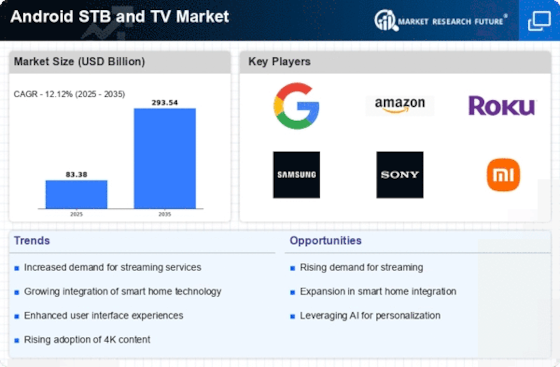

Android STB TV Market Share Analysis

In the Android Set-Top Box (STB) and TV market, market share positioning strategies are paramount for companies aiming to succeed in this ever-evolving sector. One crucial strategy involves technological differentiation. Companies invest in research and development to create innovative Android STB and TV solutions that offer superior performance, user experience, and compatibility with the latest software updates and applications. Advancements such as higher resolutions, faster processors, voice control capabilities, and seamless integration with popular streaming services set companies apart from competitors and attract consumers seeking cutting-edge entertainment solutions for their homes.

Partnerships and collaborations also play a significant role in market share positioning within the Android STB and TV market. Companies often form strategic alliances with content providers, app developers, chipset manufacturers, and streaming platforms to enhance their offerings and expand their reach. These partnerships enable companies to pre-install popular apps, optimize content delivery, and provide exclusive access to premium content, creating added value for consumers. By leveraging the strengths and resources of partners, companies can strengthen their value propositions and gain a competitive edge in the market.

Vertical specialization is another prevalent strategy in the Android STB and TV market. By focusing on specific segments such as gaming, sports, or smart home integration, companies can tailor their solutions to meet the unique preferences and lifestyles of consumers within each vertical. This targeted approach allows companies to develop specialized features, content bundles, and ecosystem integrations that cater to the specific needs and interests of their target audiences. By becoming leaders in niche markets, companies can differentiate themselves and capture a larger share of the market.

Moreover, pricing strategies are critical in market share positioning within the Android STB and TV market. Companies may adopt various pricing models, such as premium pricing for high-end devices with advanced features or more affordable options targeting price-sensitive consumers. Additionally, companies may offer financing plans, bundle discounts, or subscription-based services to attract and retain customers. By aligning pricing strategies with consumer preferences and market dynamics, companies can maximize revenue and market penetration while remaining competitive in the rapidly evolving landscape of Android STB and TV devices.

Effective marketing and branding are essential components of market share positioning strategies in the Android STB and TV market. Companies must effectively communicate their value propositions and differentiate themselves from competitors through compelling messaging and branding. This could involve highlighting key features, showcasing user testimonials, or leveraging endorsements from influencers and industry experts. Additionally, companies may utilize various marketing channels such as social media, online advertising, retail promotions, and partnerships with content creators to reach their target audiences and drive demand for their products.

Customer-centricity is increasingly becoming a focal point in market share positioning strategies within the Android STB and TV market. Companies that prioritize customer satisfaction and provide exceptional pre-sales and post-sales support can build strong brand loyalty and drive repeat business. This may involve offering personalized recommendations, responsive customer service, or extended warranties to enhance the overall ownership experience. By understanding and addressing consumer needs and preferences, companies can differentiate themselves and gain a competitive advantage in the market.

Geographical expansion is another vital strategy for companies looking to increase their market share in the Android STB and TV market. As demand for connected entertainment solutions grows globally, companies must expand their presence in key regions and target new customer segments. This could involve establishing local distribution channels, forming partnerships with regional retailers and service providers, or adapting products to meet the cultural and regulatory requirements of different markets. By effectively penetrating new territories and capturing market share, companies can drive sustained growth and success in the competitive Android STB and TV market.

Leave a Comment