Market Trends

Key Emerging Trends in the Android STB TV Market

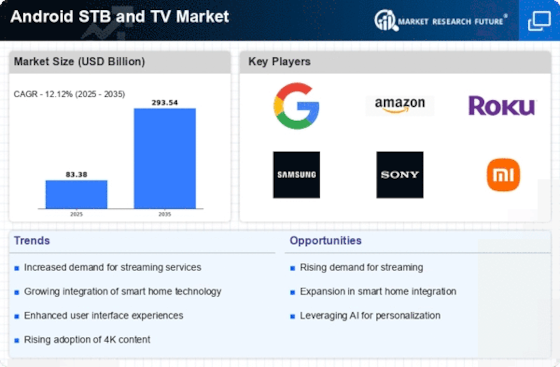

The Android Set-Top Box (STB) and TV market have been experiencing significant growth and evolution, driven by several key market trends. One of the prominent trends is the increasing adoption of streaming services and Over-the-Top (OTT) content consumption. With the rise of platforms like Netflix, Amazon Prime Video, and Disney+, consumers are moving away from traditional cable and satellite TV services towards on-demand streaming options. Android STBs and TVs offer access to a wide range of streaming apps and services through the Google Play Store, providing users with the flexibility to customize their entertainment experience and access content anytime, anywhere.

Moreover, the demand for smart home entertainment solutions and connected devices is driving the growth of the Android STB and TV market. Consumers are increasingly seeking integrated entertainment ecosystems that allow them to seamlessly access and control their favorite content across multiple devices. Android-powered STBs and TVs support features such as voice control, casting, screen mirroring, and smart home integration, enabling users to enjoy a personalized and immersive entertainment experience. Additionally, the integration of virtual assistants like Google Assistant and Amazon Alexa enhances the usability and convenience of Android STBs and TVs, enabling hands-free control and access to information and services.

Furthermore, the proliferation of high-resolution content formats such as 4K Ultra HD, HDR (High Dynamic Range), and Dolby Atmos audio is driving the demand for Android STBs and TVs capable of delivering superior picture and sound quality. Android-powered devices support advanced video and audio codecs, ensuring compatibility with the latest content formats and standards. This trend is particularly evident in the gaming and home theater segments, where consumers are seeking immersive and cinematic experiences. Android STBs and TVs with powerful processors, dedicated graphics capabilities, and support for gaming controllers cater to this growing demand for high-quality entertainment experiences.

Additionally, the convergence of traditional linear TV and online video content is reshaping the Android STB and TV market. Broadcasters and pay-TV operators are increasingly embracing IP-based delivery mechanisms and hybrid broadcast-OTT models to reach audiences across multiple platforms and devices. Android-powered STBs and TVs support features such as live TV integration, Electronic Program Guides (EPGs), and catch-up TV services, providing consumers with a seamless transition between linear and on-demand content. This convergence trend is driving the adoption of Android STBs and TVs as the preferred platform for accessing both traditional and online video content.

Moreover, the growing penetration of high-speed broadband internet and the rollout of 5G networks are fueling the demand for Android STBs and TVs with advanced connectivity features. With faster internet speeds and lower latency, consumers can stream high-definition and 4K content seamlessly on their Android-powered devices without buffering or interruptions. Additionally, the availability of Wi-Fi 6 and Ethernet connectivity options ensures reliable and stable connections, even in bandwidth-constrained environments. As streaming becomes the dominant mode of content consumption, Android STBs and TVs are well-positioned to capitalize on this trend by offering a wide range of content options and superior viewing experiences.

Leave a Comment