Increasing Demand in Agriculture

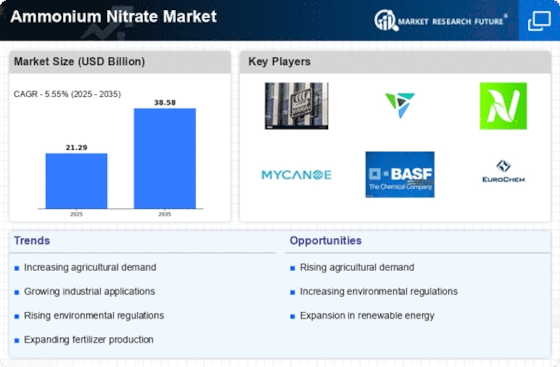

The Ammonium Nitrate Market is experiencing a surge in demand primarily driven by the agricultural sector. As a key nitrogen source, ammonium nitrate is essential for enhancing crop yields and improving soil fertility. Recent data indicates that The Ammonium Nitrate Market is projected to grow at a compound annual growth rate of approximately 3.5% over the next few years. This growth is largely attributed to the rising need for food security and sustainable agricultural practices. Farmers are increasingly adopting ammonium nitrate due to its efficiency in nutrient delivery, which is crucial for meeting the nutritional needs of crops. Consequently, the agricultural sector's reliance on ammonium nitrate is likely to bolster the market, making it a pivotal driver in the Ammonium Nitrate Market.

Rising Environmental Regulations

The Ammonium Nitrate Market is also influenced by rising environmental regulations aimed at promoting sustainable practices. Governments are implementing stricter regulations regarding the use of fertilizers, including ammonium nitrate, to mitigate environmental impacts such as water pollution and greenhouse gas emissions. This regulatory landscape is prompting manufacturers to innovate and develop more environmentally friendly formulations of ammonium nitrate. The market is witnessing a shift towards products that comply with these regulations while still meeting agricultural needs. As a result, companies that adapt to these changes may gain a competitive edge, potentially reshaping the Ammonium Nitrate Market in the coming years.

Infrastructure Development Initiatives

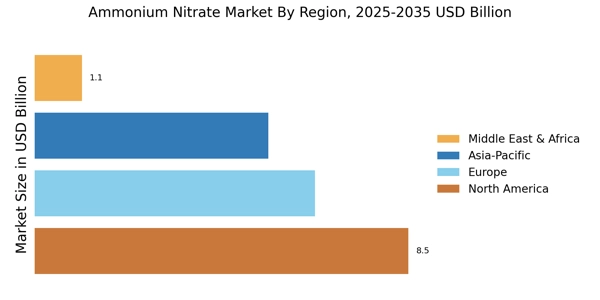

Infrastructure development initiatives are playing a crucial role in shaping the Ammonium Nitrate Market. Governments and private entities are investing heavily in construction and infrastructure projects, which often require ammonium nitrate for explosives in mining and construction activities. The construction sector is anticipated to witness a growth rate of around 4% annually, leading to increased consumption of ammonium nitrate. This trend is particularly evident in regions where mining and large-scale construction projects are prevalent. The demand for ammonium nitrate in these sectors is expected to rise, thereby driving the overall market. As infrastructure projects expand, the Ammonium Nitrate Market is likely to benefit significantly from this increased demand.

Technological Innovations in Production

Technological innovations in the production of ammonium nitrate are significantly impacting the Ammonium Nitrate Market. Advances in manufacturing processes, such as the development of more efficient synthesis methods, are enhancing production capabilities and reducing costs. For instance, the implementation of automation and digital technologies in production facilities is streamlining operations and improving product quality. These innovations not only increase the supply of ammonium nitrate but also contribute to sustainability by minimizing waste and energy consumption. As technology continues to evolve, it is likely to play a pivotal role in shaping the future of the Ammonium Nitrate Market, making it more competitive and environmentally responsible.

Growing Awareness of Nutrient Management

Growing awareness of nutrient management among farmers and agricultural stakeholders is driving the Ammonium Nitrate Market. As agricultural practices evolve, there is an increasing recognition of the importance of balanced fertilization for optimal crop performance. Ammonium nitrate, with its high nitrogen content, is becoming a preferred choice for many farmers seeking to enhance soil health and crop productivity. Educational initiatives and extension services are promoting the benefits of using ammonium nitrate, leading to higher adoption rates. This trend is expected to continue, as more farmers recognize the value of effective nutrient management strategies. Consequently, the Ammonium Nitrate Market is likely to see sustained growth as awareness and adoption increase.