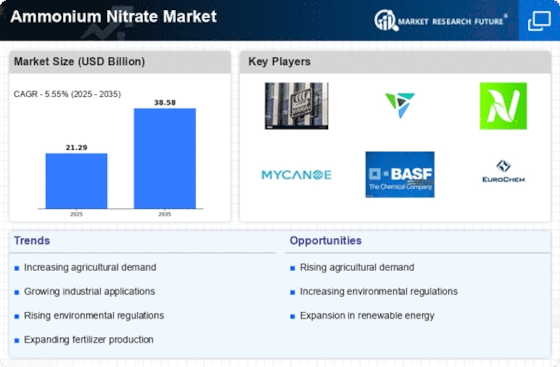

Top Industry Leaders in the Ammonium Nitrate Market

Beyond the lush fields and flourishing gardens lies a crucial, yet often invisible, contributor – the Ammonium Nitrate market. This market provides the backbone for global agriculture, fueling growth and productivity through its potent nitrogen fertilizer. But beneath the seemingly uniform layer of white crystals lies a dynamic ecosystem where leading players and nimble startups battle for market share amidst evolving trends, regulatory shifts, and technological advancements. Let's explore the strategies, factors, and recent developments shaping this fertile terrain.

Beyond the lush fields and flourishing gardens lies a crucial, yet often invisible, contributor – the Ammonium Nitrate market. This market provides the backbone for global agriculture, fueling growth and productivity through its potent nitrogen fertilizer. But beneath the seemingly uniform layer of white crystals lies a dynamic ecosystem where leading players and nimble startups battle for market share amidst evolving trends, regulatory shifts, and technological advancements. Let's explore the strategies, factors, and recent developments shaping this fertile terrain.

Strategies Nourishing Market Share:

-

Product Diversification: Leading players like Yara International, Koch Fertilizer, and EuroChem are constantly innovating, developing specialty ammonium nitrate formulations with tailored nutrient ratios and release mechanisms for specific crops and soil types. Think controlled-release ammonium nitrate for efficient nitrogen utilization and enhanced agricultural profitability. -

Sustainable Focus: Environmental consciousness is influencing the market. Players are adopting energy-efficient production processes, exploring greener raw materials like bio-based ammonia, and developing nitrification inhibitors to minimize ammonia emissions and enhance fertilizer efficiency, catering to sustainability-driven consumers and stricter environmental regulations. -

Vertical Integration: Securing reliable sources of key raw materials like ammonia and nitric acid is crucial. Companies like CF Industries and OCI Nitrogen are investing in backward integration to gain control over the supply chain and mitigate cost fluctuations. -

Geographical Expansion: Emerging economies in Africa and Asia present immense growth potential, driven by rising agricultural output and increasing food demand. Companies like Nutrien and Sociedad Química y Minera de Chile are establishing production facilities and forging partnerships in these regions to capitalize on this trend.

Factors Influencing Market Growth:

-

Agricultural Demand: Fertilizer consumption remains the primary driver, with over 60% of global ammonium nitrate production directed towards crops like corn, wheat, and rice. Rising population and changing dietary habits contribute to this demand. -

Regulation and Safety: Stringent regulations on fertilizer handling, storage, and transportation, like REACH in Europe and TSCA in the US, drive the development of safer and more compliant ammonium nitrate formulations and storage solutions. Companies adhering to these regulations gain a competitive edge. -

Technological Advancements: Research and development efforts are leading to innovative fertilizer application technologies, like precision agriculture techniques and controlled-release formulations, enhancing fertilizer efficiency and reducing environmental impact. Early adopters and innovators stand to benefit significantly from these advancements. -

Resource Availability: Fluctuations in the prices and availability of key raw materials like natural gas and ammonia can significantly impact production costs and market dynamics. Companies with diverse sourcing networks and alternative technologies have an advantage.

Key Companies in the Ammonium Nitrate market includes

- Enaex (Chile)

- EuroChem Group AG (Switzerland)

- CF Industries Holdings Inc.(U.S.)

- Incitec Pivot limited (Australia)

- Neochim Plc (Bulgaria)

- URALCHEM JSC (Russia)

- San Corporation (China)

- Austin Powder (U.S.)

- Abu Qir Fertilizers and Chemicals Company (Egypt)

- Yara International ASA (Norway)

- OSTCHEM (Austria).

Recent Developments

-

September 2023: A research breakthrough leads to the development of nanomaterial-coated ammonium nitrate with enhanced nutrient release and soil penetration, opening doors for more efficient fertilizer application. -

October 2023: Yara International unveils a new line of bio-based ammonia-derived ammonium nitrate fertilizers, targeting eco-conscious farmers and capitalizing on the growing demand for sustainable agriculture solutions. -

November 2023: A consortium of leading research institutions and fertilizer manufacturers launches a collaborative project to develop precision agriculture technologies for optimizing ammonium nitrate application and minimizing environmental impact. -

December 2023: The Ammonium Nitrate market exhibits cautious optimism for continued growth in 2024, driven by rising agricultural demand, technological advancements, and a growing focus on sustainability. However, uncertainties in resource availability and evolving regulations require careful monitoring.