Growing Demand in Pyrotechnics

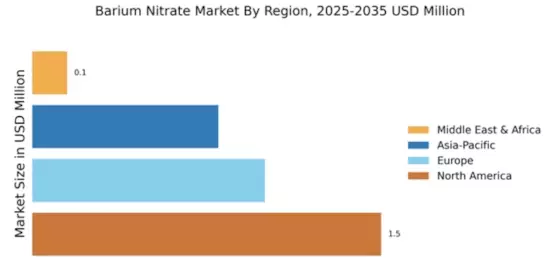

The Global Barium Nitrate Market Industry experiences a notable increase in demand due to its essential role in pyrotechnics. Barium nitrate is utilized as an oxidizer in fireworks and flares, contributing to vibrant colors and effects. As global celebrations and events continue to rise, the pyrotechnics sector is projected to expand significantly. This growth is anticipated to drive the market value, with estimates suggesting it could reach 2.65 USD Billion in 2024. The increasing popularity of fireworks displays, particularly in regions such as Asia-Pacific and North America, further supports this trend, indicating a robust future for the Global Barium Nitrate Market Industry.

Rising Applications in Electronics

The Global Barium Nitrate Market Industry benefits from the rising applications of barium nitrate in the electronics sector. Barium nitrate is utilized in the production of electronic components, particularly in the manufacture of capacitors and semiconductors. As the demand for electronic devices continues to surge, driven by advancements in technology and consumer electronics, the need for high-quality materials like barium nitrate is expected to increase. This trend is likely to contribute to the market's growth, with projections indicating a market value of 4.44 USD Billion by 2035, underscoring the importance of barium nitrate in the evolving electronics landscape.

Expansion in Chemical Manufacturing

The Global Barium Nitrate Market Industry is poised for growth due to the expansion of the chemical manufacturing sector. Barium nitrate serves as a precursor for various chemical compounds, including barium carbonate and barium sulfate, which are widely used in industries such as glass, ceramics, and pigments. As industrial activities ramp up globally, the demand for these compounds is likely to increase, thereby boosting the consumption of barium nitrate. The market is projected to grow at a CAGR of 4.8% from 2025 to 2035, reflecting the increasing reliance on barium nitrate in diverse applications within the chemical manufacturing landscape.

Market Dynamics and Competitive Landscape

The Global Barium Nitrate Market Industry is characterized by dynamic market conditions and a competitive landscape. Various players are actively engaged in enhancing their product offerings and expanding their market presence. This competitive environment encourages innovation and the development of high-purity barium nitrate products to meet specific industry requirements. Additionally, strategic partnerships and collaborations among manufacturers are becoming increasingly common, aiming to leverage synergies and enhance supply chain efficiencies. As the market evolves, these dynamics are expected to shape the future trajectory of the Global Barium Nitrate Market Industry, fostering growth and diversification.

Regulatory Support for Environmental Applications

The Global Barium Nitrate Market Industry is influenced by regulatory support for environmental applications. Barium nitrate is increasingly recognized for its potential in wastewater treatment and environmental remediation processes. Governments worldwide are implementing stricter regulations to manage industrial waste, which may drive the adoption of barium nitrate in treatment solutions. This regulatory environment creates opportunities for market growth, as industries seek compliant and effective solutions for environmental challenges. The ongoing emphasis on sustainability and environmental protection is likely to enhance the demand for barium nitrate, further solidifying its role in the Global Barium Nitrate Market Industry.