Cost Efficiency

Cost efficiency remains a vital driver in the Aluminum Honeycomb Market. The lightweight nature of aluminum honeycomb structures contributes to reduced transportation costs and improved fuel efficiency in applications such as aerospace and automotive. Additionally, the long lifespan and low maintenance requirements of these materials further enhance their cost-effectiveness. As industries seek to optimize operational expenses, the demand for aluminum honeycomb products is expected to rise. Analysts project that the market could grow by approximately 9% as businesses increasingly recognize the financial benefits associated with utilizing aluminum honeycomb solutions in their operations.

Diverse Applications

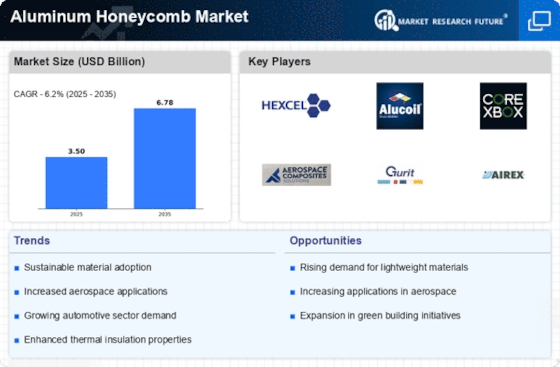

The diverse applications of aluminum honeycomb structures significantly contribute to the growth of the Aluminum Honeycomb Market. These materials are utilized across various sectors, including aerospace, automotive, construction, and marine industries. The versatility of aluminum honeycomb allows for its use in lightweight panels, insulation, and structural components, catering to a wide range of needs. As industries increasingly prioritize lightweight and high-strength materials, the demand for aluminum honeycomb products is anticipated to rise. This trend could lead to a market expansion of approximately 12% in the coming years, underscoring the importance of diverse applications in the Aluminum Honeycomb Market.

Regulatory Compliance

Regulatory compliance is a critical driver for the Aluminum Honeycomb Market. As governments implement stricter regulations regarding material safety and environmental impact, manufacturers are compelled to adopt compliant materials. Aluminum honeycomb products, known for their non-toxic properties and recyclability, align well with these regulations. This compliance not only mitigates risks associated with legal liabilities but also opens up new market opportunities. The Aluminum Honeycomb Market is likely to experience growth as companies prioritize adherence to these regulations, potentially increasing market size by 8% over the next few years.

Sustainability Initiatives

The Aluminum Honeycomb Market is increasingly influenced by sustainability initiatives. As environmental concerns gain prominence, industries are seeking materials that minimize ecological footprints. Aluminum honeycomb structures are lightweight and recyclable, making them an attractive option for manufacturers aiming to reduce waste. The market is projected to grow as companies adopt eco-friendly practices, with a potential increase in demand for aluminum honeycomb products by approximately 15% over the next five years. This shift towards sustainable materials not only aligns with regulatory requirements but also enhances brand reputation, thereby driving growth in the Aluminum Honeycomb Market.

Technological Advancements

Technological advancements play a pivotal role in shaping the Aluminum Honeycomb Market. Innovations in manufacturing processes, such as automated production techniques and improved bonding methods, enhance the performance and durability of aluminum honeycomb products. These advancements lead to cost reductions and increased efficiency, which are crucial for competitive positioning. The market is expected to witness a compound annual growth rate of around 10% as manufacturers leverage these technologies to meet the evolving demands of various sectors, including aerospace and automotive. Consequently, the integration of advanced technologies is likely to propel the Aluminum Honeycomb Market forward.