Top Industry Leaders in the Aluminum Honeycomb Market

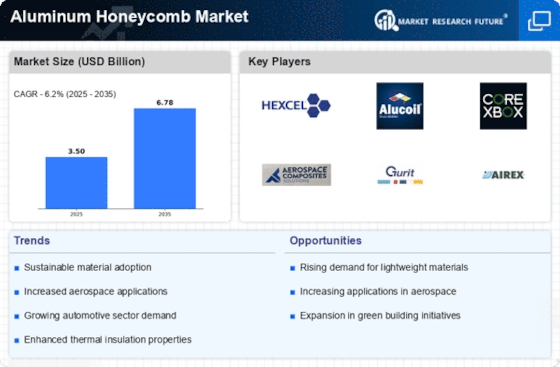

The aluminum honeycomb market, with its lightweight, high-strength structure, finds its way into diverse applications, from sleek aircraft interiors to sturdy marine vessels. This unique market landscape is a bustling hive of activity, with established players and innovative newcomers vying for a share of the honeycomb. Let's delve into the competitive strategies, key factors influencing market share, industry news, and recent developments buzzing amidst the aluminum hexagons.

The aluminum honeycomb market, with its lightweight, high-strength structure, finds its way into diverse applications, from sleek aircraft interiors to sturdy marine vessels. This unique market landscape is a bustling hive of activity, with established players and innovative newcomers vying for a share of the honeycomb. Let's delve into the competitive strategies, key factors influencing market share, industry news, and recent developments buzzing amidst the aluminum hexagons.

Market Share Strategies:

-

Innovation Hubs: Leading players like Hexcel Composites, 3A Composites, and Alcore invest heavily in R&D, creating advanced honeycomb designs with enhanced strength, fire resistance, and acoustic insulation. For example, Hexcel's EXOL honeycomb technology offers exceptional fire performance for aircraft interiors. -

Geographical Expansion: Established players are venturing into emerging markets like China and India, capitalizing on the rapid growth in construction and transportation sectors. 3A Composites' recent acquisition of Chinese company Kingreal is a case in point. -

Vertical Integration: Players like Novelis are integrating upstream aluminum production with honeycomb manufacturing, gaining control over raw material costs and supply chains.

Factors Influencing Market Share:

-

Application Diversification: Beyond traditional sectors like aerospace and marine, aluminum honeycomb finds increasing use in construction, automotive, and renewable energy sectors. This diversification presents new opportunities for players specializing in specific applications. -

Sustainability Focus: Environmental regulations and the demand for lightweight, energy-efficient materials drive the development of greener honeycomb production processes. Players utilizing recycled aluminum or bio-based adhesives gain an edge. -

Cost Optimization: While premium performance fetches a premium price, cost-effective solutions are crucial for high-volume applications. Manufacturers offering competitive pricing and optimized fabrication techniques attract cost-conscious customers.

Key Companies In The Aluminum Honeycomb Market Include

- Argosy International Inc. (U.S.)

- Plascore (Germany)

- Coach Line Industries (India)

- Alucoil (Spain)

- Corex Honeycomb (U.K.)

- Universal Metaltek (India)

- Motonity Private Limited (India)

- Benecor, Inc. (U.S.)

Recent Developments (Last 6 Months):

-

July 2023: 3A Composites unveils a new honeycomb panel with enhanced vibration damping properties, targeting noise reduction applications in trains and buses. -

September 2023: Hexcel collaborates with Boeing on a research project to explore the use of 3D-printed honeycomb structures in aircraft components, aiming for weight optimization and customization. -

October 2023: Alcore launches a new line of ultralight honeycomb panels for high-performance sailing yachts, emphasizing strength and weight reduction. -

November 2023: A Chinese consortium, led by Beijing Institute of Aeronautical Materials, successfully develops a high-temperature resistant honeycomb material for hypersonic aircraft, potentially impacting the aerospace market. -

December 2023: Renoxbell Aluminum Industrial, a major Chinese player, announces plans to expand production capacity by 50%, anticipating robust demand from the construction sector.