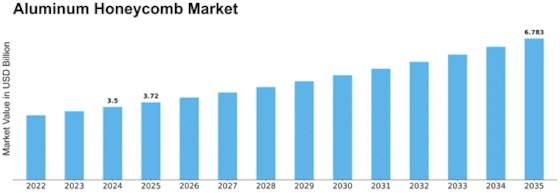

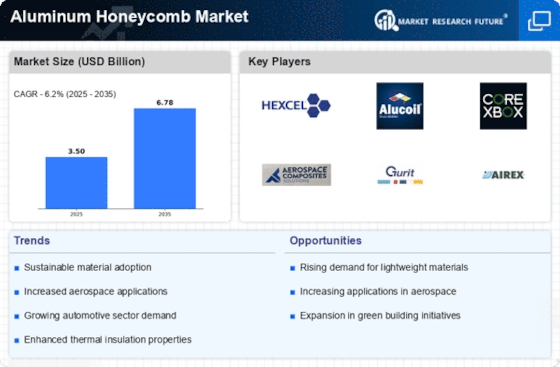

Aluminum Honeycomb Size

Aluminum Honeycomb Market Growth Projections and Opportunities

The Aluminum Honeycomb market is affected by a variety of factors. These factors, which are influenced by the numerous applications of these structures in areas such as aircrafts, transport and construction, work together to give it its character. The materials that many people want increasingly have strength and lightness properties. Aluminum honeycombs satisfy this need very well since they have excellent strength-to-weight ratios hence their stability. As these industries rise and succeed there is a huge demand for aluminum honeycombs which serve key roles in various industrial processes.

Regarding the Aluminum Honeycomb market, concerns about regulations and the environment are very crucial. For this reason, aluminum honeycombs used in lightweight structures must comply with strict regulations to ensure that products used in those structures are safe for use and not harmful towards the environment. Given that manufacturers have to meet government specifications and address conservation-oriented businesses needs, they have no option but to adhere to the guidelines provided. The global economy really affects what happens in the Aluminum Honeycomb Market. Economy influences demand for items with these honeycombs directly such as construction works, airplane manufacture as well as production of car components that require energy saving means. In times when economy blooms again, individuals tend to look out for new light materials and methods of building houses at cheaper costs thereby bringing up more demands for this material called Aluminum Honeycombs. Conversely some companies can be affected during economic recession thus causing an impact on the market.

Changes occurring within honeycomb structure technology greatly shape how markets evolve over time. New manufacturing techniques can make Aluminum Honeycombs perform better or be used in wider range of scenarios thus making them more flexible through hybrid materials or design combinations. Investments into research and development enable firms embrace changes in customer preferences while technologies increase cutting edge competencies required by serving customers better than competitors within the Aluminium Honeycomb Market.

The Aluminum Honeycomb market is affected by changes in the supply chain, such as the price and quantity of raw materials. Some of the most common aspects used to make these honeycombs are aluminum sheets, adhesive agents and cores. The price of raw materials can affect the cost of production, thus influencing the market dynamics. As a result, it is necessary to have a stable and smoothly functioning supply chain in order to ensure that there are always Aluminum Honeycombs for end users. The aim here is to provide stability for the market hence avoiding any interruptions.

Numerous trade laws and global politics also influence the Aluminum Honeycomb market. Flow of composite material around world can be influenced either by tariffs, trade agreements or political instability leading to effects on demand as well as supply. In order to survive in an ever-changing globalization era, companies need adaptability for accommodating these external forces of change with regards to international commerce.

Leave a Comment