Leading market players invested heavily in research and development (R&D) to increase their production capacity and develop innovative products, which will help the Alloys for the Automotive market expand and grow further. Market participants are also undertaking organic and inorganic approaches to expand and strengthen their global footprint, with important market developments including new product lines, contractual deals, raining funds and investments, mergers and acquisitions, capital expenditure, and strategic alliances with other organizations. The Alloys for the Automotive industry must offer cost-effective and innovative solutions to survive in a highly fragmented and competitive market.

Manufacturing locally to increase production capacity and minimize operational expenses is one of the key business strategies organizations use in the global Alloys for the Automotive industry to offer lucrative benefits to their clients and capture the untapped market share. The Alloys for the Automotive industry have offered significant advantages and technological advancements in the Automotive sector.

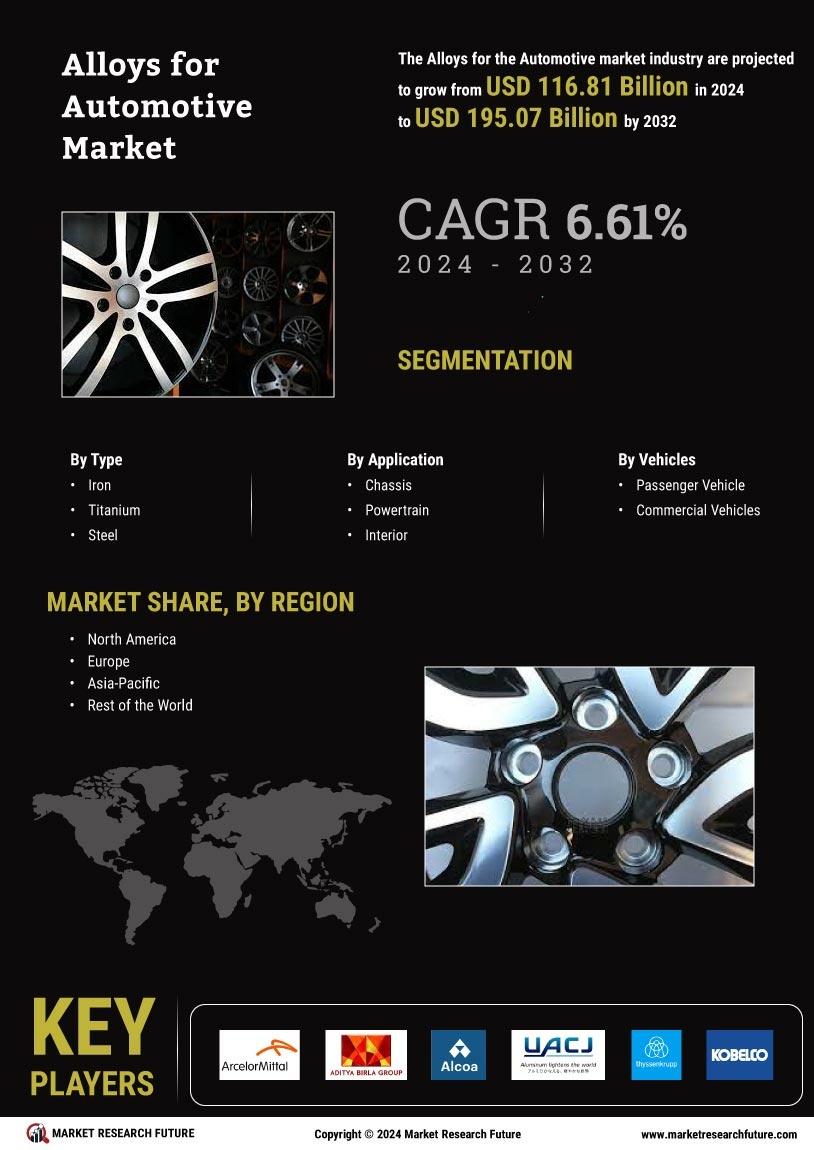

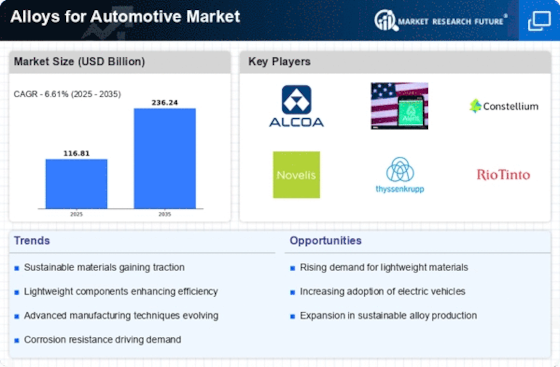

Major players in the Alloys for Automotive Market, including ArcelorMittal SA (Luxembourg), Aditya Birla Group (India), Alcoa Inc. (U.S.), UACJ Corporation (Japan), ThyssenKrupp AG (Germany), Kobe Steel, Ltd. (Japan), Norsk Hydro ASA (Norway), AMG Advanced Metallurgical Group NV (Netherlands), and Constellium (Netherlands), and AGCO Corporation (U.S), are attempting to capture market share by investing in research and development (R&D) operations to offer innovative solutions.

Alcoa is one of the largest bauxite miners globally, with first-quartile costs and high-quality reserves. Charles Martin Hall founded the Pittsburgh-based business on July 9, 1886. It functions in the following areas: Aluminum, alumina, and bauxite. It is a leading manufacturer of fabricated aluminum, primary aluminum, and alumina as a whole because of its growing and active involvement in major industry sectors: innovation, mining, refining, purifying, manufacturing, and reusing.

In July 2022, Alcoa Corporation announced that out of its three operational smelting lines, one of its facilities, Warrick Operations plants in Indiana, will be shut down shortly due to operational difficulties.

Wheel Pros is a recognized aftermarket wheel developer, marketer, and supplier. The firm also distributes superior tires and components. Jody Groce, the Company's founder, established the business in 1995. Presently the Company sells confidential, established brands recognized throughout all key vehicle segments via a network of 30 nationwide and three foreign distribution centers.

In November Wheel Pros announced in November 2020 that it had bought the assets of Performance Replicas, Inc., an established supplier of replica wheels. Performance Replicas is a renowned brand in the original equipment imitation wheel industry, having long-standing ties with well-known national and online merchants.