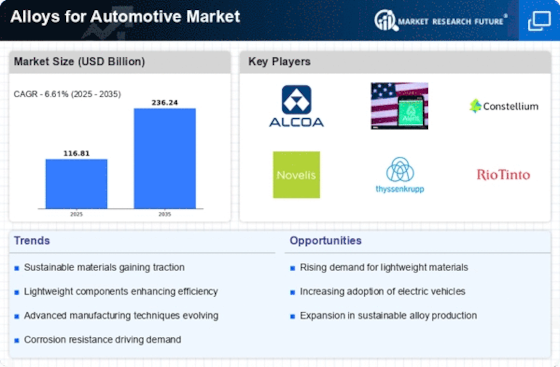

Market Analysis

In-depth Analysis of Alloys for Automotive Market Industry Landscape

The automotive industry's relentless pursuit of innovation has led to a significant emphasis on materials used in vehicle manufacturing, with alloys playing a pivotal role in enhancing performance, durability, and efficiency. Several market factors contribute to the widespread use of alloys in the automotive sector, shaping the landscape of this dynamic and evolving industry.

One of the primary market factors driving the adoption of alloys in the automotive sector is the constant demand for lightweight materials. As manufacturers strive to meet stringent fuel efficiency and emission standards, reducing the overall weight of vehicles has become paramount. Alloys, which are engineered combinations of metals, offer a compelling solution by providing strength and structural integrity without the excessive weight associated with traditional materials like steel. This not only enhances fuel efficiency but also contributes to improved handling and overall performance.

Another crucial market factor is the increasing focus on sustainability and environmental considerations. As the automotive industry aligns itself with global efforts to reduce carbon footprints, the demand for materials that are not only lightweight but also eco-friendly has risen. Alloys, with their ability to be recycled and reused, fit well within this sustainability narrative. The recyclability of alloys aligns with the automotive industry's commitment to circular economy principles, reducing waste and lowering the environmental impact of manufacturing processes.

Furthermore, the automotive market is heavily influenced by regulatory standards and safety requirements. Alloys, with their customizable properties, enable manufacturers to meet and exceed these standards. Whether it's enhancing crashworthiness or improving corrosion resistance, alloys offer a versatile solution to address various safety and regulatory concerns. This adaptability allows automakers to design vehicles that not only comply with existing regulations but also anticipate and meet future standards.

The constantly evolving landscape of consumer preferences is also a significant market factor driving the use of alloys in the automotive sector. Modern consumers are increasingly conscious of not only the environmental impact of their vehicles but also factors like aesthetics and performance. Alloys provide a means to achieve a delicate balance between form and function. With a wide range of alloy compositions available, automakers can tailor the appearance and performance of their vehicles to cater to diverse consumer preferences, thereby gaining a competitive edge in the market.

Global economic trends and market dynamics also play a role in shaping the use of alloys in the automotive industry. Fluctuations in the prices of raw materials, geopolitical factors, and trade policies can impact the cost of manufacturing. Alloys, with their ability to offer a cost-effective solution without compromising on performance, become an attractive option for automakers looking to maintain profitability in the face of economic uncertainties.

In conclusion, the market factors influencing the use of alloys in the automotive sector are multifaceted. From addressing regulatory requirements and consumer preferences to promoting sustainability and adapting to economic trends, alloys emerge as a versatile and essential component in the ongoing evolution of the automotive industry. As technological advancements continue to drive innovation, the role of alloys in shaping the future of automotive manufacturing is likely to remain pivotal.

Leave a Comment