AI in Video Surveillance Market Summary

As per Market Research Future analysis, the Ai In Video Surveillance market was estimated at 6.907 USD Billion in 2024. The ai in video surveillance market industry is projected to grow from 7.963 USD Billion in 2025 to 33.07 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 15.3% during the forecast period 2025 - 2035. This growth highlights the increasing role of artificial intelligence for video surveillance, video surveillance system AI, and surveillance AI technologies.

Key Market Trends & Highlights

The AI in Video Surveillance Market is experiencing robust growth driven by technological advancements and increasing security demands.

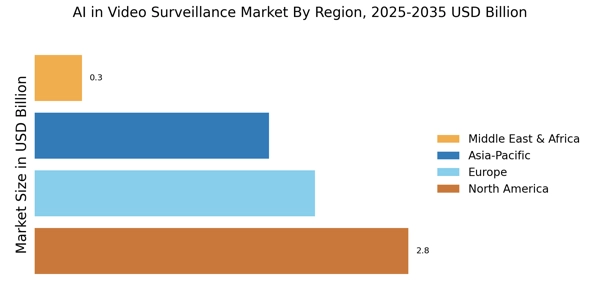

- The market is witnessing increased adoption of cloud-based solutions, particularly in North America, which remains the largest market.

- Enhanced analytics capabilities are becoming a focal point, especially within the commercial segment, which is the largest in the market.

- Privacy and ethical considerations are gaining traction, reflecting a growing awareness among consumers and businesses alike.

- The rising demand for enhanced security solutions and regulatory compliance are key drivers propelling growth in both the commercial and residential segments.

Market Size & Forecast

| 2024 Market Size | 6.907 (USD Billion) |

| 2035 Market Size | 33.07 (USD Billion) |

| CAGR (2025 - 2035) | 15.3% |

Major Players

Hikvision (CN), Dahua Technology (CN), Axis Communications (SE), Bosch Security Systems (DE), Hanwha Techwin (KR), FLIR Systems (US), Genetec (CA), Milestone Systems (DK), Honeywell (US), Cisco Systems (US)