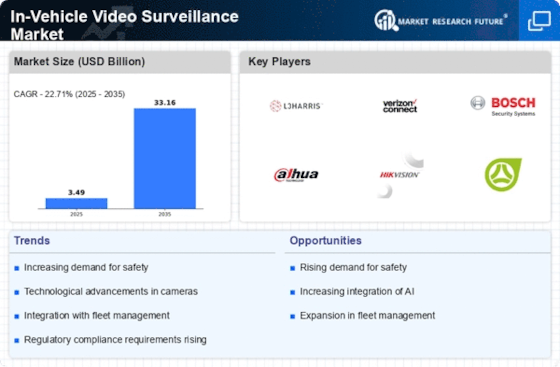

Leading market players are investing capital and resources across research and development in order to extend their product offerings, this is expected to help the In-Vehicle Video Surveillance Market, grow even more. Market participants and manufacturers are also adopting various strategic activities to grow their worldwide presence, with vital market developments including new product developments & launches, contracts & agreements, mergers & acquisitions, increased investments, and collaboration with other similar organizations. To expand and survive in a more competitive and rising market climate, In-Vehicle Video Surveillance industry must offer cost-effective items.

The manufactures are making use of locally available resources to minimize the production costs which will aid the growth of the In-Vehicle Video Surveillance industry to benefit clients and increase the market sector. In recent years, the In-Vehicle Video Surveillance industry has offered some of the most significant advantages to medicine. Major players in the In-Vehicle Video Surveillance Market, including Bosch Group, Delphi Automotive PLC, Zheijiang Dahua Technology Co. Ltd., Advantech Co. Ltd., Nexcom International Co. Ltd., Hangzhou Hikvision Digital Technology Co.

Ltd., Amplicon Liveline Ltd., and others, are attempting to increase market demand by investing in research and development operations.

A provider of multimedia software is Cyberlink Co Ltd. It creates and sells software for digital video and audio applications. The business sells its goods in a variety of markets, including media creativity suite, backup and burn, webcam apps, video editing, photography, and e-learning. Its operating reach extends to North America, Japan, Europe, and the Asia-Pacific region. The company offers comprehensive video, photo, & audio editing solutions for the creators of every levels of skills and across all devices, such as PCs, Chromebooks, tablets, and smartphones, with their award-winning Director software suite.

In April 2023, The People Tracker product was just unveiled by CyberLink Corp., a leader in AI and facial recognition technologies. Artificial intelligence (AI) people tracking technology is widely utilised in the security and surveillance industries to identify and follow the movements of specific individuals. The effectiveness of video searches and investigation times are substantially increased, boosting surveillance capabilities for tracking people of interest, locating the missing or lost more quickly, and enhancing security in general.

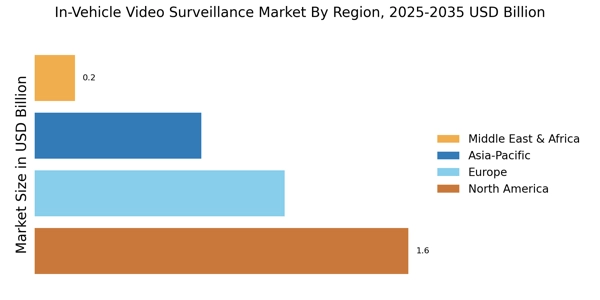

A provider of technology and services, Robert Bosch GmbH (Bosch) is a division of Robert Bosch Stiftung GmbH. The business provides a broad range of goods and services, including automotive components and accessories, e-bike systems, automotive technology, home appliances, security systems, solar inverters, packaging technology, industry solutions, and business process management solutions. The company serves clients in the automotive, consumer electronics, and BPO sectors in the Americas, Europe, Asia Pacific, and Africa along with sales and service partners, subsidiaries, and local businesses. The headquarters of Bosch is in Stuttgart, Germany.

In April 2020, A new camera platform called INTEOX, developed by Bosch to modernize the security and safety sector, is now available. With INTEOX, the first fully open platform of its kind, consumers, system integrators, and application developers have unrestricted creative and personalization options.