Rising Security Concerns

The AI CCTV Market is significantly influenced by the increasing concerns regarding security and safety. With the rise in crime rates and terrorist activities, organizations and governments are investing heavily in surveillance systems to protect assets and ensure public safety. According to recent statistics, the global crime rate has seen a notable increase, prompting a shift towards advanced surveillance solutions. AI-enabled CCTV systems offer enhanced monitoring capabilities, allowing for proactive measures against potential threats. This heightened focus on security is likely to propel the demand for AI CCTV Market solutions across various sectors, including urban areas, commercial establishments, and critical infrastructure.

Technological Advancements in AI

The AI CCTV Market is experiencing rapid technological advancements that enhance surveillance capabilities. Innovations in machine learning and computer vision are enabling AI systems to analyze video feeds in real-time, improving threat detection and response times. For instance, the integration of facial recognition technology has shown a potential increase in identification accuracy by up to 95%. This capability is particularly valuable in high-security environments such as airports and financial institutions. Furthermore, the development of edge computing allows for data processing closer to the source, reducing latency and bandwidth usage. As these technologies evolve, they are likely to drive demand for AI CCTV Market systems, making them more appealing to various sectors, including retail and transportation.

Regulatory Compliance and Standards

The AI CCTV Market is also shaped by the need for compliance with regulatory standards and guidelines. Governments are increasingly implementing regulations that mandate the use of advanced surveillance technologies to ensure public safety and privacy. For example, the introduction of data protection laws requires organizations to adopt AI CCTV Market systems that are capable of secure data handling and storage. This regulatory landscape is pushing businesses to invest in AI-enabled surveillance solutions that not only meet compliance requirements but also enhance operational efficiency. As organizations strive to align with these regulations, the demand for AI CCTV Market systems is expected to rise, fostering growth in the market.

Integration with Smart City Initiatives

The AI CCTV Market is benefiting from the integration of surveillance systems into smart city initiatives. As urban areas evolve into smart cities, the demand for intelligent surveillance solutions is increasing. AI CCTV Market systems play a crucial role in monitoring traffic, managing public safety, and enhancing urban planning. For instance, cities are deploying AI-enabled cameras to analyze traffic patterns, which can lead to improved traffic management and reduced congestion. This integration not only enhances the efficiency of city operations but also contributes to the overall safety of urban environments. As more cities adopt smart technologies, the AI CCTV Market is likely to see substantial growth.

Increased Investment in Security Infrastructure

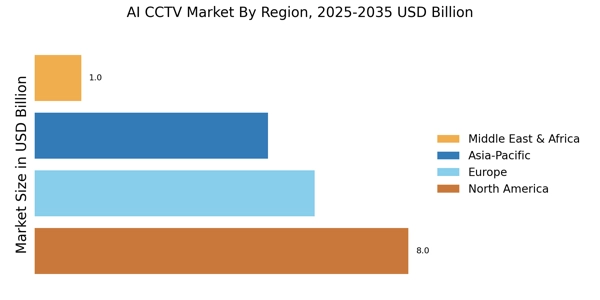

The AI CCTV Market is witnessing a surge in investment aimed at enhancing security infrastructure. Organizations across various sectors are allocating significant budgets to upgrade their surveillance systems, recognizing the importance of advanced technologies in safeguarding assets. Reports indicate that The AI CCTV Market is projected to reach substantial figures in the coming years, with a considerable portion directed towards AI-driven solutions. This trend is driven by the need for more effective monitoring and response capabilities, as traditional systems often fall short in addressing modern security challenges. As investments in security infrastructure continue to rise, the demand for AI CCTV Market systems is expected to grow, further solidifying their role in contemporary security strategies.