Technological Advancements in AI

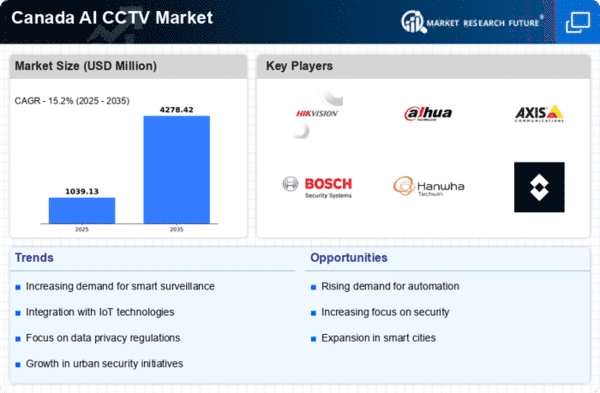

Rapid advancements in artificial intelligence technologies are significantly impacting the ai cctv market. Innovations such as facial recognition, object detection, and behavior analysis are enhancing the capabilities of surveillance systems. These technologies enable more efficient monitoring and analysis of video feeds, allowing for real-time responses to potential threats. In Canada, the integration of AI in surveillance systems is expected to grow at a CAGR of around 15% over the next five years. This growth is indicative of the increasing reliance on intelligent systems to improve security measures. As organizations continue to adopt these advanced technologies, the ai cctv market is poised for substantial growth, driven by the demand for smarter and more effective surveillance solutions.

Growing Demand for Security Solutions

The increasing need for enhanced security measures across various sectors in Canada is driving the ai cctv market. Businesses, government facilities, and residential areas are increasingly adopting advanced surveillance systems to mitigate risks associated with theft, vandalism, and other criminal activities. According to recent data, the security services market in Canada is projected to reach approximately $10 billion by 2026, indicating a robust growth trajectory. This demand is further fueled by the rising awareness of safety and security among the public, leading to a greater investment in ai cctv technologies. As organizations seek to protect their assets and ensure the safety of individuals, the ai cctv market is likely to experience significant expansion in the coming years.

Increased Investment in Smart City Initiatives

The push towards smart city initiatives in Canada is significantly influencing the ai cctv market. Municipalities are increasingly investing in intelligent infrastructure that incorporates advanced surveillance technologies to enhance public safety and improve urban living conditions. These initiatives often include the integration of ai cctv systems to monitor traffic, manage public spaces, and ensure the safety of citizens. With the Canadian government allocating substantial funds for smart city projects, the ai cctv market is likely to see a surge in demand. Reports suggest that investments in smart city technologies could exceed $2 billion by 2028, indicating a promising outlook for the ai cctv market as cities evolve into more connected and secure environments.

Regulatory Support for Surveillance Technologies

The Canadian government is actively promoting the adoption of advanced surveillance technologies, including ai cctv systems, through various regulatory frameworks. Initiatives aimed at enhancing public safety and security are encouraging organizations to invest in modern surveillance solutions. For instance, the implementation of the National Security and Intelligence Review Agency (NSIRA) has led to increased funding for security technologies. This regulatory support is likely to bolster the ai cctv market, as businesses and public institutions seek to comply with safety standards while enhancing their security infrastructure. The market is expected to benefit from these initiatives, potentially leading to a market valuation exceeding $1 billion by 2027.

Rising Urbanization and Infrastructure Development

Canada's ongoing urbanization and infrastructure development are contributing to the growth of the ai cctv market. As cities expand and new infrastructure projects emerge, the need for effective surveillance systems becomes increasingly critical. Urban areas are particularly vulnerable to crime, necessitating the deployment of advanced security solutions. The Canadian urban population is projected to reach 38 million by 2030, creating a substantial market for ai cctv technologies. This demographic shift is likely to drive investments in surveillance systems, as municipalities and private entities prioritize safety and security in their development plans. Consequently, the ai cctv market is expected to thrive in response to these urbanization trends.