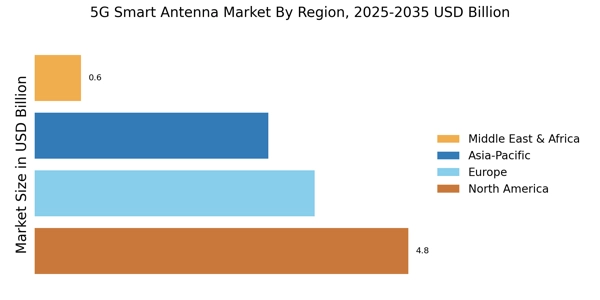

Expansion of Smart Cities Initiatives

The development of smart cities is significantly influencing the 5G Smart Antenna Market. As urban areas increasingly adopt smart technologies to improve infrastructure and services, the demand for reliable and efficient communication systems rises. Smart cities rely on interconnected devices that require robust 5G networks, which in turn necessitate advanced smart antennas. Reports suggest that investments in smart city projects are expected to exceed several trillion dollars in the coming years, creating a substantial market opportunity for smart antenna manufacturers. This trend indicates a growing recognition of the importance of 5G technology in enhancing urban living, thereby driving the growth of the 5G Smart Antenna Market.

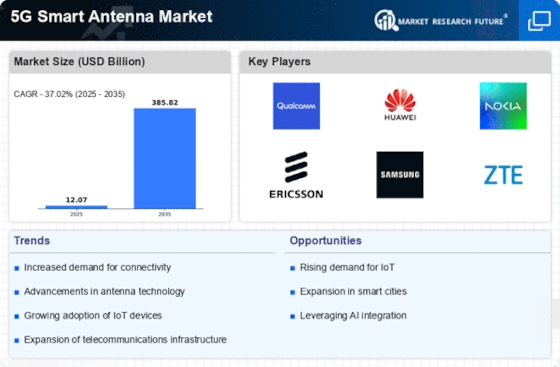

Rising Demand for High-Speed Connectivity

The 5G Smart Antenna Market is experiencing a surge in demand for high-speed connectivity, driven by the increasing reliance on mobile data and the proliferation of smart devices. As consumers and businesses alike seek faster internet speeds, the need for advanced antenna technologies becomes paramount. According to recent estimates, the number of 5G subscriptions is projected to reach over 1 billion by 2025, indicating a robust growth trajectory. This demand is further fueled by the expansion of 5G networks, which require sophisticated smart antennas to optimize signal quality and coverage. Consequently, manufacturers are investing in research and development to enhance antenna performance, thereby positioning themselves favorably within the competitive landscape of the 5G Smart Antenna Market.

Technological Advancements in Antenna Design

Technological advancements in antenna design are propelling the 5G Smart Antenna Market forward. Innovations such as beamforming, massive MIMO, and adaptive antennas are enhancing the capabilities of smart antennas, allowing for improved signal strength and coverage. These advancements enable network operators to efficiently manage bandwidth and reduce interference, which is vital for the successful implementation of 5G networks. As the demand for high-performance antennas grows, manufacturers are increasingly focusing on developing cutting-edge solutions that meet the evolving needs of the market. This focus on innovation is likely to drive competition and foster growth within the 5G Smart Antenna Market.

Growing Need for Enhanced Network Reliability

The growing need for enhanced network reliability is a significant factor influencing the 5G Smart Antenna Market. As businesses and consumers become more dependent on uninterrupted connectivity, the demand for antennas that can provide consistent performance under various conditions increases. This need is particularly pronounced in sectors such as healthcare, finance, and transportation, where reliable communication is critical. The 5G Smart Antenna Market is responding to this demand by developing antennas that can withstand environmental challenges and maintain high performance. As a result, manufacturers are likely to prioritize the creation of robust and resilient antenna solutions, further driving the growth of the market.

Increased Investment in Telecommunications Infrastructure

Investment in telecommunications infrastructure is a critical driver for the 5G Smart Antenna Market. Governments and private entities are allocating significant resources to upgrade existing networks and deploy new 5G infrastructure. This investment is essential for meeting the rising demand for mobile broadband services and ensuring that networks can support the anticipated increase in data traffic. For instance, it is estimated that global spending on 5G infrastructure will surpass 300 billion dollars by 2025. Such financial commitments are likely to accelerate the deployment of smart antennas, which are crucial for optimizing network performance and enhancing user experience. As a result, the 5G Smart Antenna Market stands to benefit from this influx of capital.