Government Regulations and Standards

The automotive smart-antenna market is significantly influenced by government regulations and standards aimed at enhancing vehicle safety and communication capabilities. In the US, regulatory bodies are increasingly mandating the integration of advanced communication technologies in vehicles, which directly impacts the demand for smart antennas. For instance, the Federal Communications Commission (FCC) has established guidelines for the use of specific frequency bands for automotive applications. As a result, manufacturers are compelled to innovate and comply with these regulations, leading to the development of more efficient and effective antenna systems. This regulatory environment is expected to drive market growth, as compliance with safety and communication standards becomes a critical factor for automotive manufacturers.

Rising Demand for Connectivity Features

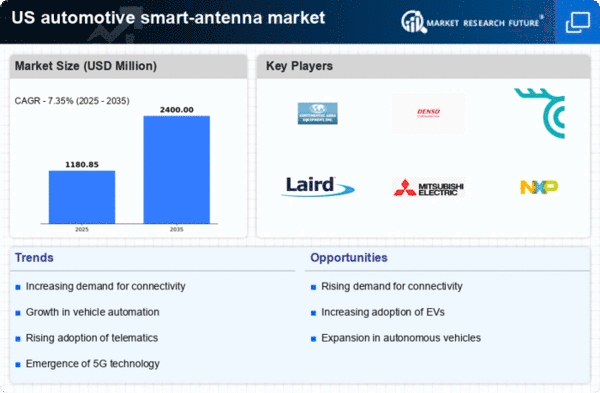

The automotive smart-antenna market is experiencing a surge in demand driven by the increasing consumer preference for connectivity features in vehicles. As vehicles become more integrated with smart technologies, the need for advanced antenna systems that support various communication protocols, such as V2X (Vehicle-to-Everything), is becoming paramount. In 2025, it is estimated that nearly 70% of new vehicles will be equipped with some form of connectivity, necessitating the adoption of sophisticated smart antennas. This trend is further supported by the growing popularity of infotainment systems and telematics, which require reliable and high-performance antennas to function effectively. Consequently, manufacturers are focusing on developing innovative solutions that enhance connectivity, thereby propelling the automotive smart-antenna market forward.

Growth of Electric and Autonomous Vehicles

The automotive smart-antenna market is poised for growth due to the rising adoption of electric and autonomous vehicles. As these vehicles rely heavily on advanced communication systems for navigation, safety, and connectivity, the demand for high-performance smart antennas is likely to increase. In 2025, it is projected that electric vehicles will account for approximately 25% of new car sales in the US, further emphasizing the need for sophisticated antenna solutions. Autonomous vehicles, in particular, require robust communication capabilities to interact with their environment, necessitating the integration of smart antennas that can support multiple communication protocols. This shift towards electric and autonomous vehicles is expected to create new opportunities for innovation within the automotive smart-antenna market.

Technological Advancements in Antenna Design

The automotive smart-antenna market is benefiting from rapid technological advancements in antenna design and materials. Innovations such as MIMO (Multiple Input Multiple Output) technology and the use of advanced materials are enhancing the performance and efficiency of smart antennas. These advancements allow for better signal reception and transmission, which is crucial for modern vehicles that rely on various communication systems. In 2025, the market is expected to witness a significant increase in the adoption of these advanced antenna technologies, as manufacturers seek to improve vehicle connectivity and user experience. The continuous evolution of antenna design is likely to play a pivotal role in shaping the future of the automotive smart-antenna market.

Consumer Preference for Enhanced User Experience

The automotive smart-antenna market is increasingly driven by consumer preferences for enhanced user experiences in vehicles. As consumers demand more integrated and seamless connectivity features, automotive manufacturers are compelled to invest in advanced antenna technologies that can support these requirements. The rise of smartphone integration, in-car Wi-Fi, and advanced navigation systems has created a need for high-quality smart antennas that can deliver reliable performance. In 2025, it is anticipated that consumer expectations will continue to evolve, pushing manufacturers to prioritize the development of innovative antenna solutions that enhance the overall driving experience. This shift in consumer behavior is likely to significantly impact the automotive smart-antenna market.