Cost Efficiency

Cost efficiency is a significant factor influencing the Global 3D Printing Medical Devices Market Industry. The ability to produce complex medical devices in-house reduces manufacturing costs and minimizes waste. Hospitals and clinics are increasingly adopting 3D printing technologies to create surgical instruments and models, which can lead to substantial savings. As the market evolves, the anticipated compound annual growth rate of 11.64% from 2025 to 2035 suggests that cost-effective solutions will play a crucial role in driving adoption. This trend reflects a broader shift towards more sustainable healthcare practices.

Regulatory Support

Regulatory support is emerging as a vital driver for the Global 3D Printing Medical Devices Market Industry. Governments and regulatory bodies are increasingly recognizing the potential of 3D printing in healthcare and are establishing frameworks to facilitate its adoption. For instance, the FDA has streamlined the approval process for certain 3D printed devices, encouraging innovation and market entry. This supportive environment is likely to foster growth, as manufacturers can navigate regulatory hurdles more efficiently. The positive regulatory landscape may contribute to the market's expansion, aligning with the projected growth trajectory.

Market Growth Projections

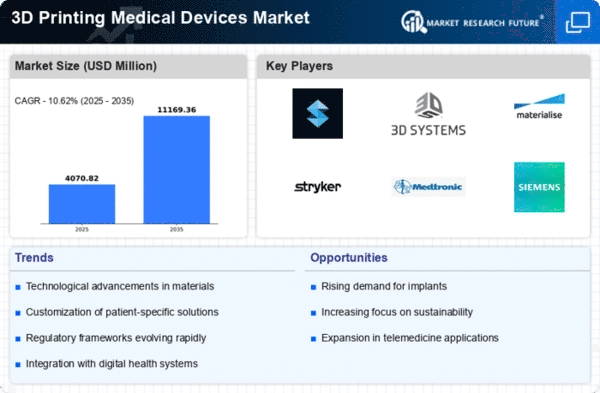

The Global 3D Printing Medical Devices Market Industry is poised for substantial growth, with projections indicating a market value of 12.4 USD Billion by 2035. This growth trajectory is underpinned by a compound annual growth rate of 11.64% from 2025 to 2035. The increasing integration of 3D printing technologies in various medical applications, including prosthetics, implants, and surgical tools, is expected to drive this expansion. As healthcare providers seek innovative solutions to enhance patient care, the market is likely to witness a surge in demand for 3D printed medical devices, reflecting a transformative shift in the industry.

Technological Advancements

The Global 3D Printing Medical Devices Market Industry is propelled by rapid technological advancements in 3D printing techniques. Innovations such as bioprinting and the development of advanced materials are enhancing the capabilities of medical devices. For instance, the introduction of bioinks that mimic human tissue allows for the creation of more complex structures, potentially improving patient outcomes. As of 2024, the market is valued at approximately 3.68 USD Billion, indicating a growing acceptance of these technologies in healthcare. This trend is expected to continue, with advancements likely to drive further growth in the sector.

Customization and Personalization

Customization and personalization are increasingly recognized as key drivers in the Global 3D Printing Medical Devices Market Industry. The ability to produce patient-specific implants and prosthetics enhances the effectiveness of treatments and improves patient satisfaction. For example, 3D printed orthopedic implants can be tailored to fit the unique anatomy of individual patients, leading to better surgical outcomes. This trend is expected to contribute to the market's growth, with projections indicating a rise to 12.4 USD Billion by 2035. The demand for personalized medical solutions is likely to continue influencing the market positively.

Rising Demand for Advanced Healthcare Solutions

The rising demand for advanced healthcare solutions is a critical driver of the Global 3D Printing Medical Devices Market Industry. As healthcare systems worldwide strive to improve patient outcomes, the integration of 3D printing technology offers innovative solutions. The ability to create complex, patient-specific devices addresses the growing need for precision medicine. This demand is reflected in the market's projected growth, with an increase from 3.68 USD Billion in 2024 to 12.4 USD Billion by 2035. The focus on advanced healthcare solutions is likely to sustain momentum in the adoption of 3D printing technologies.