Technological Advancements

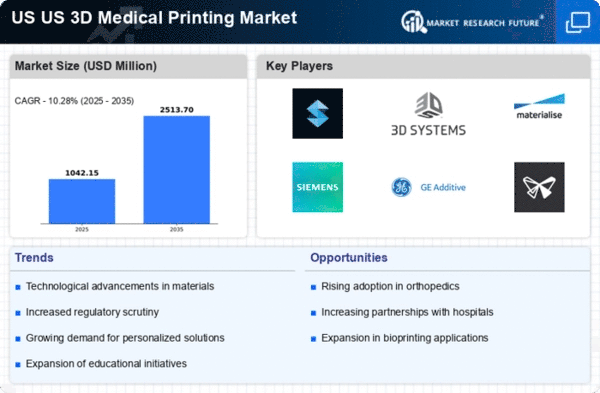

The US 3D Medical Printing Market is experiencing rapid technological advancements that enhance the capabilities of 3D printing. Innovations in materials, such as biocompatible polymers and metals, are expanding the range of applications in medical devices and implants. For instance, the introduction of multi-material printing allows for the creation of complex structures that mimic natural tissues. Furthermore, advancements in software for design and simulation are streamlining the production process, reducing time and costs. According to recent data, the market is projected to grow at a compound annual growth rate (CAGR) of over 20% through 2026, driven by these technological improvements. This growth indicates a strong demand for more efficient and effective medical solutions, positioning the US as a leader in the global 3D medical printing landscape.

Regulatory Support and Frameworks

The regulatory environment plays a significant role in shaping the US 3D Medical Printing Market. The Food and Drug Administration (FDA) has established guidelines that facilitate the approval process for 3D printed medical devices, ensuring safety and efficacy. This regulatory support encourages innovation and investment in the sector, as companies can navigate the approval process more efficiently. Moreover, the FDA's initiatives to promote the use of additive manufacturing in healthcare signal a commitment to advancing this technology. As a result, the market is likely to see an influx of new products and applications, contributing to its expansion. The establishment of clear regulatory frameworks is essential for fostering trust among healthcare providers and patients alike.

Collaborative Research and Development

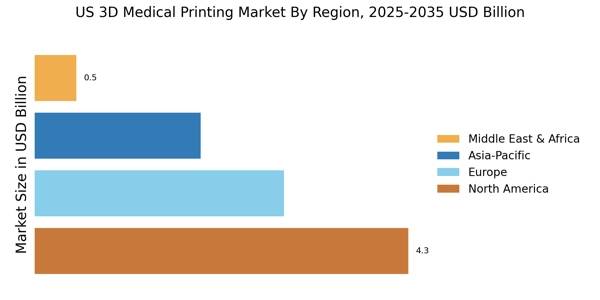

Collaborative research and development initiatives are emerging as a vital driver in the US 3D Medical Printing Market. Partnerships between academic institutions, healthcare providers, and industry players are fostering innovation and accelerating the development of new applications. These collaborations often focus on addressing specific medical challenges, such as creating bioprinted tissues for regenerative medicine or developing advanced surgical models for training purposes. Data indicates that such partnerships are likely to increase, with funding for research in 3D printing technologies projected to rise significantly in the coming years. This collaborative approach not only enhances the technological capabilities of 3D printing but also ensures that the solutions developed are aligned with the needs of the healthcare sector, thereby driving market growth.

Rising Demand for Customized Solutions

Customization is a pivotal driver in the US 3D Medical Printing Market, as healthcare providers increasingly seek tailored solutions for patients. The ability to produce patient-specific implants and prosthetics enhances treatment outcomes and patient satisfaction. For example, 3D printing enables the creation of orthopedic implants that fit the unique anatomy of individual patients, reducing the risk of complications. Market data suggests that the demand for customized medical devices is expected to rise significantly, with a projected market value reaching several billion dollars by 2026. This trend reflects a broader shift towards personalized medicine, where treatments are designed to meet the specific needs of each patient, thereby driving growth in the 3D medical printing sector.

Cost Efficiency and Resource Optimization

Cost efficiency is a crucial factor propelling the US 3D Medical Printing Market. Traditional manufacturing methods for medical devices often involve high material waste and lengthy production times. In contrast, 3D printing minimizes waste by using only the necessary amount of material, which can lead to substantial cost savings. Additionally, the ability to produce complex geometries in a single print reduces the need for multiple components, further streamlining production. Recent analyses indicate that healthcare facilities adopting 3D printing technologies can reduce costs by up to 30% in certain applications. This financial advantage is particularly appealing to hospitals and clinics facing budget constraints, thereby fostering the growth of the 3D medical printing market in the US.