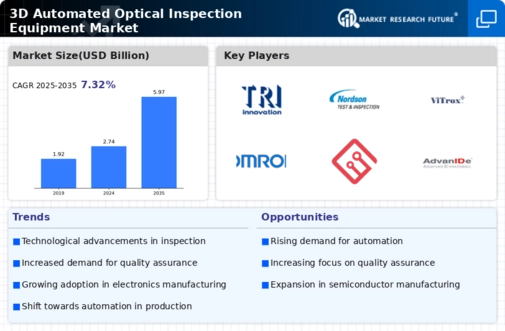

Rising Demand for Quality Assurance

The increasing emphasis on quality assurance in manufacturing processes drives the 3D Automated Optical Inspection Equipment Market. As industries strive to enhance product reliability and minimize defects, the adoption of advanced inspection technologies becomes paramount. In 2025, the market is projected to witness a growth rate of approximately 10% annually, reflecting the urgent need for precision in production. This demand is particularly pronounced in sectors such as electronics and automotive, where even minor defects can lead to significant financial losses. Consequently, manufacturers are investing in 3D automated optical inspection systems to ensure compliance with stringent quality standards, thereby fostering a robust market environment.

Emergence of Smart Manufacturing Practices

The emergence of smart manufacturing practices is reshaping the 3D Automated Optical Inspection Equipment Market. As industries adopt Industry 4.0 principles, the integration of automation and data exchange becomes essential. This shift encourages the implementation of 3D automated optical inspection systems that can seamlessly connect with other manufacturing processes. In 2025, the market is expected to benefit from the growing trend of interconnected systems, which enhance operational efficiency and reduce downtime. The ability to collect and analyze data in real-time allows manufacturers to make informed decisions, thereby driving the demand for advanced inspection technologies. This trend indicates a promising future for the 3D automated optical inspection equipment market.

Regulatory Compliance and Industry Standards

Regulatory compliance and adherence to industry standards significantly influence the 3D Automated Optical Inspection Equipment Market. As regulatory bodies impose stricter guidelines on product quality and safety, manufacturers are compelled to invest in advanced inspection technologies. This trend is particularly evident in sectors such as pharmaceuticals and food processing, where compliance is non-negotiable. The market is projected to grow as companies prioritize investments in 3D automated optical inspection systems to meet these regulatory requirements. Furthermore, the increasing focus on sustainability and environmental standards may also drive the adoption of these technologies, as they contribute to waste reduction and resource efficiency.

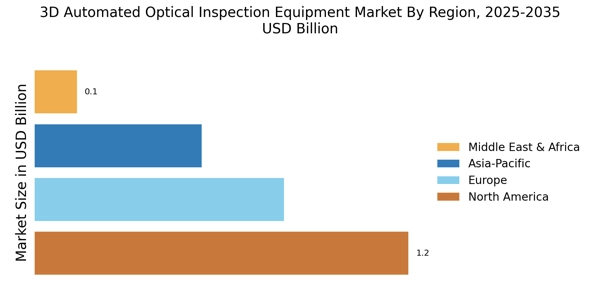

Growth of the Electronics Manufacturing Sector

The electronics manufacturing sector is a significant driver of the 3D Automated Optical Inspection Equipment Market. With the proliferation of smart devices and the Internet of Things, the need for efficient and reliable inspection systems has surged. In 2025, the electronics sector is anticipated to account for over 40% of the total market share, underscoring its pivotal role. As manufacturers seek to optimize production lines and reduce time-to-market, the adoption of 3D automated optical inspection systems becomes increasingly vital. This trend is likely to continue as the demand for miniaturized components and complex assemblies grows, necessitating advanced inspection solutions to ensure product integrity.

Technological Advancements in Inspection Systems

Technological advancements play a crucial role in shaping the 3D Automated Optical Inspection Equipment Market. Innovations in imaging technologies, such as high-resolution cameras and sophisticated algorithms, enhance the accuracy and speed of inspections. These advancements enable manufacturers to detect defects at an unprecedented level of detail, which is essential in high-stakes industries like aerospace and medical devices. The market is expected to expand as companies increasingly adopt these cutting-edge technologies to maintain competitive advantages. Furthermore, the integration of real-time data analytics into inspection systems allows for immediate feedback and corrective actions, further driving the demand for 3D automated optical inspection equipment.