Market Analysis

In-depth Analysis of ASEAN energy transition market Industry Landscape

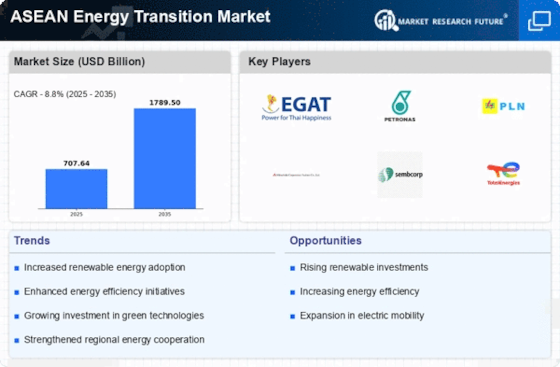

The ASEAN energy transition market is set to reach a significant value by 2032, growing at a 10.50% CAGR between years 2023-2032. One of the main factors is high demand in energy resources due to growing economies, urbanization and population is creating dynamic changes in ASEAN energy transition market. Sustainable development is an issue that ASEAN nations have recently focused on promoting the transition from dirty sources to cleaner and more sustainable ones. This is a transitional stage being fuelled by varied factors such as environmental concerns, international commitments to cut carbon emissions and the economic benefits that come with phase out of fossil fuel dependence. Technology development is critical in controlling the dynamics of ASEAN energy transition market. Technical progress in those energy renewable technologies, energy storage solutions and intelligent network systems help to strengthen the efficiency and reliability of transition process. The technologies that are being adopted in the 10 ASEAN member countries avail energy from environment friendly sources such as solar, wind and hydro power which is a diversified type of resilient landscape. These technological advances shape market trends and prompt investment development in sustainable energy infrastructure. Other factors that also greatly affect market dynamics within the ASEAN region are extensive government policies and regulatory frameworks. Governments are rolling out ambitious energy transition master plans where targets have been set on renewable capacity, whilst supportive policies aimed at attracting investments in the industry. In the industry, subsidies and regulatory incentives could generate better market opportunities to businesses and investors who thus get an opportunity for a cleaner energy solution. The economic backdrop in the ASEAN region plays an essential role as one of many factors that influence market dynamics concerning energy transition. More importantly, economic growth often leads to increased demand for energy as is the case with industrialization and infrastructural development. The energy efficiency initiative supports economic aims. However, the renewable power integration ensures there is a way out to sustainable development and while it minimizes reliance on traditional nonrenewables as sources of fossil fuel. Cost of the renewable technologies, as one of economic factors influencing investment decisions and overall market dynamics also affect this process. This is a geopolitical approach towards the consideration of ASEAN energy transition market. The regional cooperation of the ASEAN states, international partnerships and geopolitical alignments have an impact on knowledge transfer and technology transfers as well cross- border energy initiatives. Energy transition sphere regional cooperation changes market mechanisms through the creation of a favorable environment for investments, technology exchange and interconnected energy grids. The market transition of energy in ASEAN is also affected by public awareness and the demand for society. Greater environmental awareness and the associated need to reduce carbon footprint serves as a stimulus for demand on more renewable, eco-friendly energy.

Leave a Comment