Infertility Market Overview

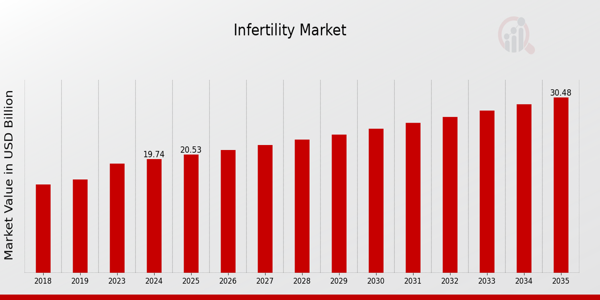

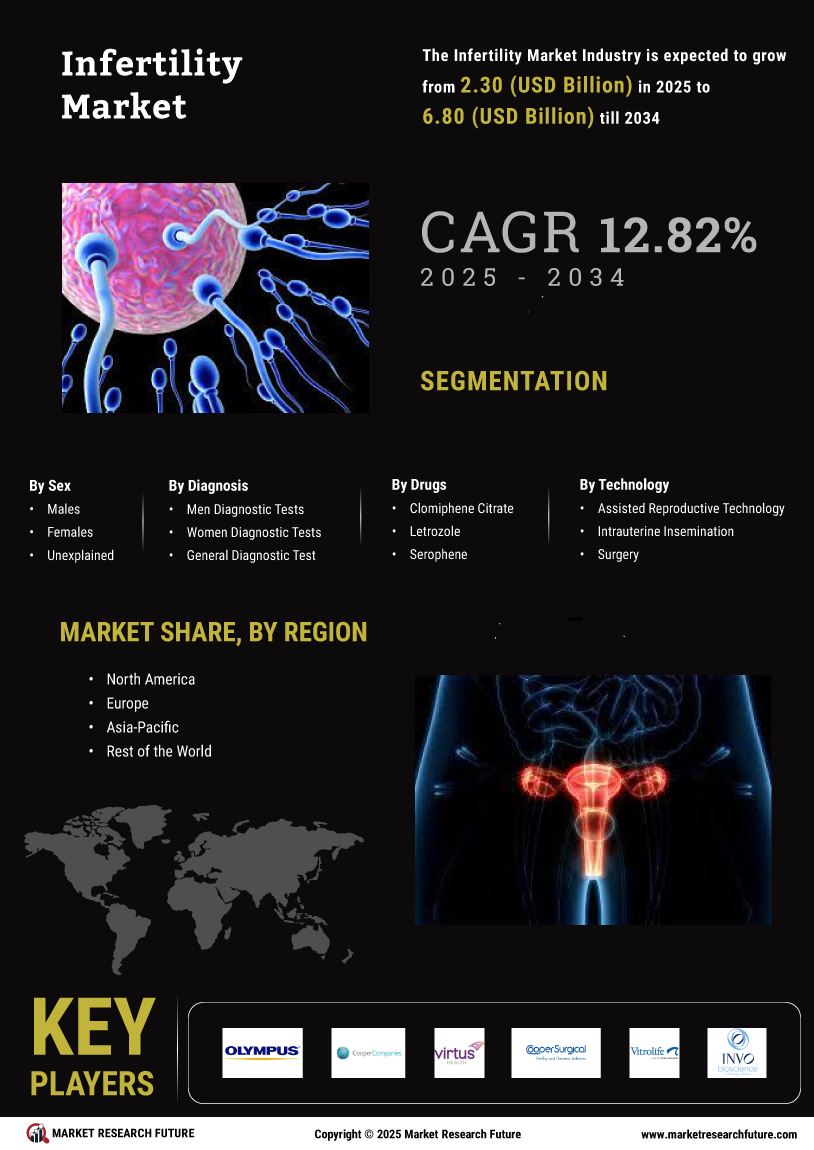

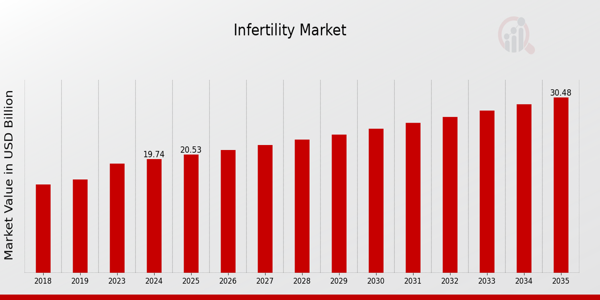

As per MRFR analysis, the Infertility Market Size was estimated at 18.97 (USD Billion) in 2023.The Infertility Market Industry is expected to grow from 19.74(USD Billion) in 2024 to 30.5 (USD Billion) by 2035. The Infertility Market CAGR (growth rate) is expected to be around 4.03% during the forecast period (2025 - 2035).

Key Infertility Market Trends Highlighted

The Global Infertility Market is currently being impacted by a number of significant market trends that are driven by the evolution of societal norms and the advancement of medical technology. As a result of the increasing prevalence of infertility and the growing awareness of reproductive health issues, a greater number of couples are increasingly seeking fertility treatments.

The rising average age of first-time parents is one of the primary market drivers, as more individuals prioritize their education and careers before establishing families. This trend is especially evident in regions like North America and Europe, where societal changes have altered traditional family planning timelines. Opportunities in this market include the increasing popularity of fertility preservation techniques, such as egg storage, which are becoming more prevalent.

This alternative is appealing to those who wish to postpone parenthood for personal or professional reasons. Furthermore, the potential for growth is substantial due to the advancements in personalized medicine and assisted reproductive technologies. Fertility clinics continue to draw an increasing number of patients due to the advancement of non-invasive procedures and the enhanced success rates of in vitro fertilization (IVF) techniques. In recent years, there has been a significant increase in the use of telemedicine and online consultations, which has facilitated access to fertility specialists and reduced geographic barriers to care.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Infertility Market Drivers

Increasing Awareness and Acceptance of Infertility Treatments

In the Global Infertility Market Industry, there has been a significant increase in public awareness and acceptance of infertility treatments, which is a major driver of market growth. Education about various infertility issues and treatment options has improved due to initiatives led by global organizations such as the World Health Organization (WHO) and the American Society for Reproductive Medicine (ASRM).

These organizations have reported that approximately 15% of couples of reproductive age experience infertility, prompting a rise in demand for assisted reproductive technologies (ART).Furthermore, the number of fertility clinics has increased considerably, with estimates showing up to 2000 clinics now operational worldwide. This expanding network not only provides accessible care but also encourages more couples to seek treatment, thus fostering a growing market. The heightened public discourse around infertility, bolstered by social media campaigns and counseling services, has led to greater acceptance and willingness to pursue treatment, ultimately contributing to the projected growth of the Global Infertility Market.

Technological Advancements in Fertility Treatments

The Global Infertility Market Industry is experiencing robust growth due to continual technological advancements in fertility treatments. Innovations such as In Vitro Fertilization (IVF) techniques and genetic screening are positively impacting success rates. For instance, recent developments in preimplantation genetic testing (PGT) have been shown to improve IVF outcomes by identifying viable embryos with the least genetic risk, thus encouraging more couples to opt for these advanced procedures.

Data from health technology organizations suggest that the success rates of IVF procedures have increased by approximately 20% due to these advancements over the last decade. Organizations such as the European Society of Human Reproduction and Embryology (ESHRE) actively promote these technologies, contributing to the market's growth as they disseminate crucial information regarding successful fertility solutions.

Rising Incidence of Lifestyle-Related Disorders

A significant driver for the growth of the Global Infertility Market Industry is the rising incidence of lifestyle-related disorders that adversely affect fertility. According to the World Health Organization (WHO), lifestyle factors such as obesity, smoking, and lack of exercise have led to a noticeable increase in infertility cases, with about 25% of couples citing lifestyle issues as a contributing factors to their infertility.

Reports have indicated that obesity rates have surged globally, with the number of obese individuals tripling since 1975.This rise has been linked to hormonal imbalances, which play a critical role in reproductive health. As more individuals become aware of these correlations, the demand for infertility treatments is expected to rise sharply, thus driving market growth.

Infertility Market Segment Insights

Infertility Market Treatment Type Insights

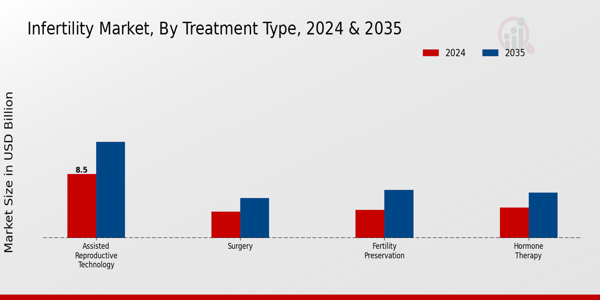

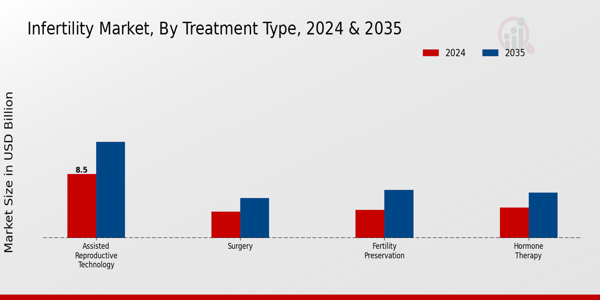

The Global Infertility Market, particularly in the Treatment Type segment, showcases a diverse range of avenues catering to individuals facing fertility challenges. By 2024, the market is expected to see significant valuation, driven by escalating demand for innovative and effective treatments. One crucial area, Assisted Reproductive Technology, holds a dominant position, anticipated to reach a valuation of 8.5 USD Billion in 2024 and projected to grow to 12.8 USD Billion by 2035.

This segment reflects its importance as a primary method for couples struggling with infertility, providing options like in vitro fertilization (IVF) that have a marked success rate.Hormone Therapy, another vital category within this market, is valued at approximately 4.0 USD Billion in 2024, with expectations of reaching 6.0 USD Billion in 2035. This treatment remains significant due to its role in regulating hormonal levels, thereby enhancing fertility potential.

Surgery, capturing a valuation of 3.5 USD Billion in 2024 and expected to grow to 5.3 USD Billion by 2035, also plays a critical role, particularly in addressing physical obstructions or abnormalities that affect fertility. Furthermore, Fertility Preservation, valued at 3.74 USD Billion in 2024 and projected to reach 6.4 USD Billion in 2035, caters to individuals looking to safeguard their fertility for the future, often crucial for those considering delayed parenthood.Such growth trends in these treatment types underline the rising recognition of infertility as a serious health concern, driving both demand and innovation.

Overall, the Global Infertility Market segmentation in Treatment Type presents robust growth opportunities, reinforced by increasing awareness of treatment options and continuous advancements in medical technologies. This expanding market is reflective of broader societal shifts, where factors such as delayed parenthood, lifestyle changes, and various health conditions contribute significantly to infertility, necessitating the adoption of these treatments.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Infertility Market End User Insights

The Global Infertility Market revenue is significantly influenced by the End User segment, encompassing various healthcare settings that provide infertility treatments and related services. By 2024, the market is expected to be valued at 19.74 billion USD, reflecting a growing emphasis on the need for effective reproductive health solutions globally.

Hospitals typically represent a considerable part of the Global Infertility Market segmentation, offering comprehensive care, advanced technology, and accessibility to specialists, which is vital for complex infertility cases.Fertility Clinics play an essential role in providing personalized services and innovative treatments tailored for couples facing fertility challenges, making them a critical player in the overall market dynamics. Home Care Settings are increasingly important as they offer convenience and a more comfortable environment for patients undergoing treatments, reflecting a trend toward more patient-centric care options.

Overall, the market growth opportunities within these environments are supported by rising infertility awareness and increasing acceptance of assisted reproductive technologies worldwide, bolstering the Global Infertility Market industry and driving improvements in reproductive health outcomes.The evolving landscape highlights the importance of tailored care, underscoring the diverse needs within the Global Infertility Market data and enhancing patient experience.

Infertility Market Gender Insights

The Global Infertility Market is poised for significant growth, with a projected value of 19.74 billion USD in 2024 and reaching 30.5 billion USD by 2035. This market segmentation by Gender plays a crucial role in understanding the dynamics of infertility treatment across different demographics. The Female segment remains an essential focus due to various factors such as age-related fertility decline and increasing demand for assisted reproductive technologies.

Meanwhile, the Male segment has also gained attention as male infertility contributes substantially to overall fertility challenges.In recent years, there has been growing awareness of male reproductive health issues, which is driving the need for innovative solutions. Additionally, the increased prevalence of lifestyle-related health issues, such as obesity and stress, impacts both genders and contributes to the demand for infertility treatments.

The continuous advancements in Research and Development and the rise in support networks for couples facing infertility are further propelling the Global Infertility Market growth. Understanding this segmentation is vital, as both Female and Male segments are significant for shaping treatment strategies and addressing the personal and emotional aspects of infertility globally.

Infertility Market Cause of Infertility Insights

The Global Infertility Market revenue is significantly driven by the various causes of infertility, encompassing key areas such as Ovulatory Disorders, Uterine or Cervical Abnormalities, Tubal Factors, and Male Factor Infertility. As of 2024, the overall market is projected to reach a valuation of 19.74 billion USD, with an expected consistent growth trajectory towards 2035. Ovulatory Disorders frequently represent a substantial contributor to infertility, emphasizing the importance of effective diagnosis and treatment options.

Meanwhile, Uterine or Cervical Abnormalities play a critical role in hindering conception, thereby further complicating fertility issues.Tubal Factors also significantly impact fertility rates, with blockages and damage to the fallopian tubes often necessitating advanced medical interventions. Male Factor Infertility is increasingly recognized as a dominant issue affecting couples; research indicates that this factor is essential for overall fertility assessments and treatments.

The challenges in addressing these various infertility causes are met with evolving opportunities in the Global Infertility Market industry, driven by research and development efforts targeting more effective therapies and patient management strategies.

Infertility Market Regional Insights

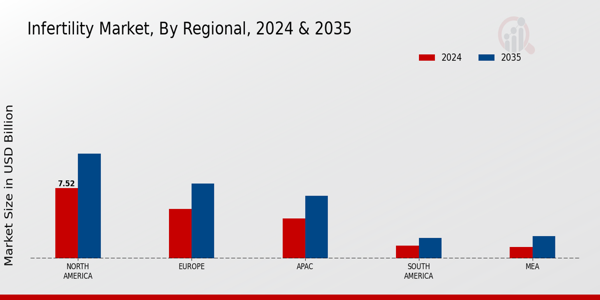

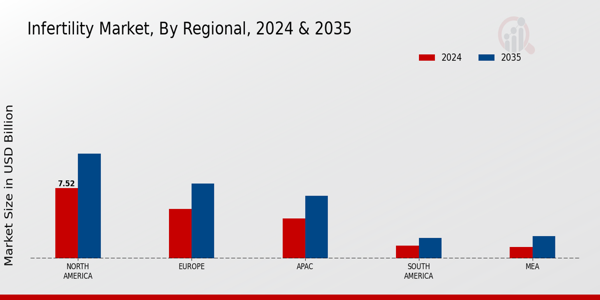

The Global Infertility Market demonstrates significant growth, with a comprehensive valuation reaching 19.74 USD Billion in 2024. Regionally, North America holds a majority share, valued at 7.52 USD Billion in 2024 and poised to grow to 11.2 USD Billion by 2035, reflecting substantial investment in reproductive health technologies and increasing awareness of infertility treatments.

Europe follows, with a valuation of 5.3 USD Billion in 2024, showcasing a well-established health infrastructure and favorable policies supporting infertility treatments, expected to reach 8.0 USD Billion by 2035.The Asia-Pacific (APAC) region, with a valuation of 4.3 USD Billion in 2024, is witnessing rapid urbanization and a rise in disposable income, which are driving factors for market growth, projected to increase to 6.7 USD Billion by 2035.

South America, though smaller, still contributes with a valuation of 1.4 USD Billion in 2024, as cultural shifts are beginning to increase the demand for infertility solutions, projected to reach 2.2 USD Billion by 2035. The Middle East and Africa (MEA) is also on the rise, valued at 1.22 USD Billion in 2024, reflecting potential due to improving healthcare access, expected to grow to 2.4 USD Billion by 2035.These regional dynamics underline the diverse landscape of the Global Infertility Market, driven by unique cultural, economic, and healthcare factors.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Infertility Market Key Players and Competitive Insights

The Global Infertility Market has become a dynamic sector, driven by the increasing prevalence of infertility and the rising awareness of assisted reproductive technologies. Various factors, such as delayed marriages, lifestyle changes, and environmental influences, have contributed to the growing demand for infertility treatments across the globe.

As a result, numerous companies are vying for market share, offering a range of services from IVF procedures to hormone drugs and reproductive health services. Key players in the market are continually innovating and expanding their product offerings to meet the diverse needs of patients, making it increasingly competitive.

The market landscape is characterized by strategic partnerships, mergers, and acquisitions as companies seek to consolidate their positions and leverage complementary strengths in their pursuit of advancements in reproductive health.Ferring Pharmaceuticals has established a significant presence in the Global Infertility Market, recognized for its focus on reproductive medicine and women's health.

The company is well-known for its dedication to innovation and research, continually investing in the development of cutting-edge fertility treatments designed to improve success rates for couples facing infertility challenges. Ferring Pharmaceuticals excels in delivering high-quality products and personalized services that cater to the varying needs of patients, further strengthening its market position. Their robust portfolio includes a range of hormone treatments that are pivotal in fertility protocols.

By maintaining an emphasis on scientific excellence and patient-centered approaches, Ferring Pharmaceuticals has managed to carve out a strong foothold in this competitive arena, fostering relationships with healthcare providers to support patient journeys through infertility treatment.Boston IVF has positioned itself firmly within the Global Infertility Market, known for its comprehensive services that encompass all facets of reproductive health.

The company offers a wide array of treatments, including IVF, egg freezing, and fertility preservation, supported by a commitment to utilizing advanced technologies and innovative techniques. Boston IVF focuses on personalized patient care, enhancing the overall experience for individuals seeking fertility solutions. The company’s strategic growth includes partnerships with various healthcare entities and participation in clinical trials to advance reproductive health knowledge and technology.

Furthermore, Boston IVF continues to expand its geographical footprint through strategic mergers and acquisitions aimed at enhancing accessibility to its wide range of services. The dedication of Boston IVF to delivering quality and excellence in patient outcomes underlines its strengths within the competitive landscape of the Global Infertility Market, showcasing its leadership and commitment to excellence in reproductive healthcare.

Key Companies in the Infertility Market Include

- Ferring Pharmaceuticals

- Boston IVF

- OvaScience

- Thermo Fisher Scientific

- Cook Medical

- IVF Technologies

- CryoBank

- Merck KGaA

- MediCorp

- Vitrolife

- Genea Limited

- CooperSurgical

- ReproTech

- Irvine Scientific

- Eugin Group

Infertility Market Industry Developments

The Global Infertility Market has seen notable developments recently, driven by advancements in reproductive technologies and increased awareness surrounding infertility issues. Companies such as Ferring Pharmaceuticals, Boston IVF, and Merck KGaA have been actively involved in launching innovative fertility treatments.

For instance, in July 2023, Ferring Pharmaceuticals introduced a new product aimed at enhancing fertility efficiency, which is anticipated to improve patient outcomes. Significant mergers and acquisitions also characterize the market; Cook Medical acquired MediCorp in August 2023, aiming to expand its portfolio in reproductive health technologies, with major implications for collaboration and innovation in the sector. Furthermore, the valuation of companies like IVF Technologies and Vitrolife has surged due to rising demand for assisted reproductive technologies, reflecting a broader trend of increasing allocations towards Research and Development in this area.

Over the last couple of years, a substantial shift towards telemedicine in fertility consultations has transformed patient access and care, indicating evolving consumer preferences in the Global Infertility Market landscape. As awareness grows and technology advances, the market is poised for sustained growth in the upcoming years.

Infertility Market Segmentation Insights

-

Infertility Market Treatment Type Outlook

- Assisted Reproductive Technology

- Hormone Therapy

- Surgery

- Fertility Preservation

-

Infertility Market End User Outlook

- Hospitals

- Fertility Clinics

- Home Care Settings

-

Infertility Market Gender Outlook

- Female

- Male

-

Infertility Market Cause of Infertility Outlook

- Ovulatory Disorders

- Uterine or Cervical Abnormalities

- Tubal Factors

- Male Factor Infertility

-

Infertility Market Regional Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2023 |

18.97(USD Billion) |

| MARKET SIZE 2024 |

19.74(USD Billion) |

| MARKET SIZE 2035 |

30.5(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

4.03% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Billion |

| KEY COMPANIES PROFILED |

Ferring Pharmaceuticals, Boston IVF, OvaScience, Thermo Fisher Scientific, Cook Medical, IVF Technologies, CryoBank, Merck KGaA, MediCorp, Vitrolife, Genea Limited, CooperSurgical, ReproTech, Irvine Scientific, Eugin Group |

| SEGMENTS COVERED |

Treatment Type, End User, Gender, Cause of Infertility, Regional |

| KEY MARKET OPPORTUNITIES |

Increased awareness and education, Advancements in reproductive technologies, Rising demand for IVF services, Growing investment in fertility clinics, Expansion of fertility preservation services |

| KEY MARKET DYNAMICS |

Rising infertility rates, Advancements in reproductive technology, Increasing public awareness, Government funding and support, Growing trend of delayed parenthood |

| COUNTRIES COVERED |

North America, Europe, APAC, South America, MEA |

Infertility Market Highlights:

Frequently Asked Questions (FAQ) :

The Global Infertility Market is expected to be valued at 19.74 USD Billion in 2024.

By 2035, the Global Infertility Market is anticipated to reach a valuation of 30.5 USD Billion.

The expected CAGR for the Global Infertility Market from 2025 to 2035 is 4.03%.

North America is anticipated to hold the largest market share, valued at 7.52 USD Billion in 2024.

The market size for Assisted Reproductive Technology is expected to reach 12.8 USD Billion by 2035.

Major players include Ferring Pharmaceuticals, Boston IVF, OvaScience, and Thermo Fisher Scientific.

The European market for infertility is projected to grow to 8.0 USD Billion by 2035.

The Fertility Preservation market segment is estimated to be valued at 3.74 USD Billion in 2024.

South America is expected to reach a market valuation of 2.2 USD Billion by 2035.

The Surgery segment is expected to grow from 3.5 USD Billion in 2024 to 5.3 USD Billion by 2035.