Infertility Size

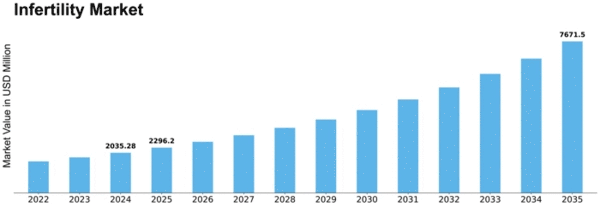

Infertility Market Growth Projections and Opportunities

The increasing incidence of infertility worldwide has a significant impact on the infertility market. A growing number of people are seeking fertility treatments due to various factors such as delayed childbirth, changes in lifestyle, and environmental variables. This has shaped the market's expansion to address various causes of infertility. Evolutionary sociodemographic patterns influence market dynamics, such as postponed marriage and childbirth. The need for infertility treatments rises when individuals and couples put off family planning, fueling the growth of the market for age-related reproductive issues. The infertility market heavily relies on the emphasis placed on reproductive health education and awareness. People are more likely to seek reproductive care when they are more informed about family planning, fertility alternatives, and accessible therapies. This has an impact on market trends and the normalization of fertility treatments. Variations in healthcare infrastructure globally impact the accessibility and adoption of infertility treatments. Differences in medical facilities, expertise, and resources influence the market's penetration in regions and healthcare settings. Important factors to consider are the psychological effects of infertility and the awareness of mental health issues. Growing recognition of the psychological difficulties linked to infertility shapes consumer behavior and propels the incorporation of psychosocial support services in reproductive clinics. Technological developments aid growth in the industry in genetic testing for diseases related to fertility. Genetic screening and preimplantation genetic testing (PGT) provide information on the health of embryos, affecting market preferences and the selection of viable embryos for reproductive treatments. The growth of telemedicine and remote consultations impacts the delivery of follow-up treatment and fertility consultations. Remote healthcare services increase access to fertility expertise and influence consumer choices, particularly for patients in rural or underserved locations. Public policy initiatives and insurance coverage for fertility treatments impact market trends. Increasing advocacy for insurance coverage and supportive public policies contribute to improved accessibility to infertility treatments, influencing market dynamics.

Leave a Comment