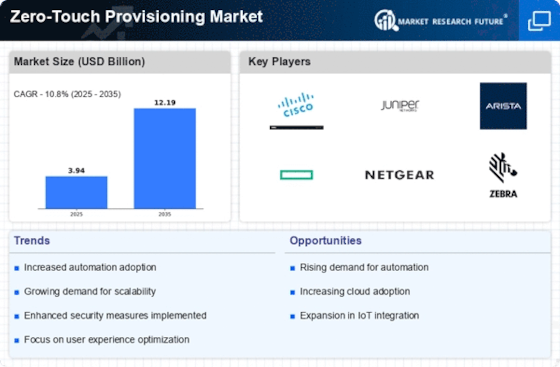

Leading market players are investing heavily in research and development in order to expand their Product lines, which will help the Zero-Touch Provisioning Market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Zero-Touch Provisioning Industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global Zero-Touch Provisioning Industry to benefit clients and increase the market sector. In recent years, the Zero-Touch Provisioning Industry has offered some of the most significant advantages to medicine. Major players in the Zero-Touch Provisioning Market, including Cisco Systems, Inc., Nokia Corporation, Telefonaktiebolaget LM Ericsson, Huawei Technologies Co., Ltd., ZTE Corporation, Juniper Networks, Inc., Hewlett Packard Enterprise Development LP, Arista Networks, Inc., Extreme Networks, Riverbed Technology, are attempting to increase market demand by investing in research and development operations.

Intent-based solutions for networking, security, collaboration, apps, and the cloud are integrated by Cisco Systems Inc (Cisco). The company sells wireless equipment, controllers, access points, switches, modules, routers, and interfaces. The company's products and technology assist its customers in managing additional network connections from devices, users, and other entities. Oil and gas, education, financial services, government, healthcare, mining, sports, media, entertainment, retail, utilities, and transportation are just a few of the many industries that Cisco supports. Through its direct sales team and channel partners, which include service providers, system integrators, distributors, and resellers, it markets its solutions.

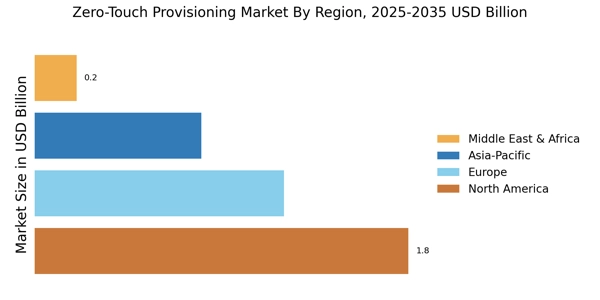

Across the Americas, Europe, the Middle East, Africa, Asia-Pacific, Japan, and China, the company has business and operational presence. The U.S. city of San Jose, California, is home to Cisco. Cisco and American television provider DISH Wireless entered into a contract in November 2021.

Intelligent solution and cloud-based service provider Hewlett Packard Enterprise Co (HPE). The company's product line includes software, converged systems, servers, storage devices, networking goods, cloud service-based products, and bespoke financial solutions. Additionally, it offers services for IT consulting, IT support, instruction, and training. Small and medium-sized organizations, financial services, healthcare, manufacturing, and telecommunications industries are among the commercial and big enterprise groups HPE serves. Resellers, distribution partners, original equipment manufacturers, independent software vendors, system integrators, and direct sales teams are all ways that HPE distributes its products.

Hewlett Packard Enterprise and Qualcomm Technologies, Inc., a pioneer in wireless technology, cooperated in February 2022.