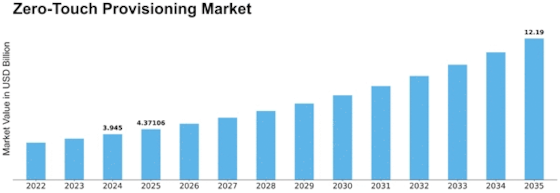

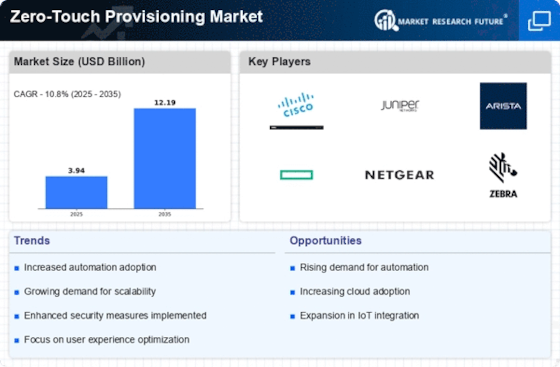

Zero Touch Provisioning Size

Zero-Touch Provisioning Market Growth Projections and Opportunities

Zero-Contact Provisioning (ZTP) has become a major aspect of organization and device management, changing how companies communicate and manage their systems. The Zero-Contact Provisioning market is shaped by mechanical advances, automation, and IT infrastructure growth.

Zero-Contact Provisioning allows devices and organization components to be configured and sent without human intervention. This streamlines the provisioning procedure, saving time and resources for device setup and management. The need for agility and productivity in complex IT environments drives ZTP's market components.

Modern IT infrastructure complexity drives Zero-Contact Provisioning market growth. A consistent and automated provisioning method becomes essential as companies adopt distributed computing, Web of Things (IoT), and edge calculating. ZTP addresses this need by standardizing and automating setup and transmission, allowing devices to be swiftly integrated into the organization without user intervention.

The growing importance of organization security shapes ZTP's market. As digital threats evolve, companies are emphasizing safe and reliable provisioning. Zero-Contact Provisioning uses established security measures to transfer devices safely. This improves security and ensures that devices comply with authorities from the start.

The arrival of 5G technology also drives Zero-Contact Provisioning market aspects. As 5G networks grow more widespread, the number of connected devices will increase, needing a flexible and efficient provisioning system. ZTP's automated and standardised methodology helps 5G companies manage the massive device flood by ensuring that they can be quickly and reliably coordinated into the ecosystem.

ZTP's market aspects are also influenced by wider digital transformation. Advanced change campaigns are underway throughout industries to be competitive and responsive to market demands. Zero-Contact Provisioning supports this pattern by promptly sending and managing the computerized framework needed for advanced modification with deftness and development.

Despite competition, some retailers are helping the Zero-Contact Provisioning sector grow. These suppliers offer device provisioning, computerization, coordination, and investigation. In the serious arena, customer experience, adaptability, and industrial requirements are prioritized."

Leave a Comment