Market Share

Wood Based Panels Market Share Analysis

Market share positioning strategies in the Wood Based Panels Market are crucial for companies to establish and maintain their competitive edge. These strategies involve various tactics aimed at capturing a larger portion of the market and ensuring sustained growth. One common approach is differentiation, where companies offer unique products or services that set them apart from competitors. This could involve developing innovative paneling solutions with distinct features such as enhanced durability, eco-friendly materials, or aesthetic appeal. By differentiating their offerings, companies can attract customers who value these specific attributes, thus carving out a niche for themselves in the market.

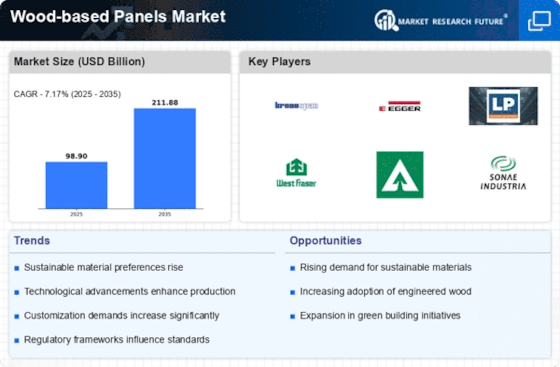

Rapid urbanization coupled with increase in demand for green buildings are some of the major factors which helps in enhancing the growth of the wood-based panels market. Furthermore, the manufacturers use expansion strategy in order to strengthen their position in the market. Hence, the global wood-based panels market is expected to witness a CAGR of around 8% over the forecast period.

Another key strategy is pricing, which plays a significant role in determining market share. Companies can adopt different pricing strategies based on their objectives and market dynamics. For instance, a company may choose to offer competitive pricing to gain market share rapidly, especially in price-sensitive segments. On the other hand, premium pricing can be leveraged by companies focusing on quality and targeting upscale segments willing to pay a higher price for superior products. Additionally, companies may implement promotional pricing strategies such as discounts, bundling, or seasonal offers to stimulate demand and gain a competitive advantage.

Distribution also plays a vital role in market share positioning strategies. Companies need to ensure their products are readily available to customers through efficient distribution channels. This could involve partnering with distributors, retailers, or e-commerce platforms to expand their reach and accessibility. Moreover, companies may invest in logistics and supply chain management to streamline operations and minimize lead times, thereby improving customer satisfaction and gaining a competitive edge in the market.

Furthermore, effective marketing and branding strategies are essential for companies to establish a strong market presence and differentiate themselves from competitors. This involves creating compelling brand messaging, engaging in targeted advertising campaigns, and leveraging digital marketing channels to reach and influence potential customers. Building a reputable brand image helps instill trust and loyalty among customers, driving repeat purchases and ultimately increasing market share.

In addition to these strategies, companies must also focus on innovation and continuous improvement to stay ahead in the Wood Based Panels Market. This could involve investing in research and development to create new products or improve existing ones, staying abreast of technological advancements, and adapting to changing customer preferences and industry trends. By consistently innovating and evolving, companies can maintain their relevance in the market and attract a larger share of customers.

Moreover, strategic partnerships and collaborations can also play a significant role in market share positioning. By teaming up with complementary businesses or industry players, companies can access new markets, technologies, or distribution channels, thus expanding their reach and market share. Strategic alliances can also provide opportunities for synergies and shared resources, enabling companies to achieve greater efficiency and competitiveness in the market.

Leave a Comment