Regulatory Support

Regulatory frameworks are increasingly supporting the Wood-based Panels Market, promoting the use of sustainable materials in construction and manufacturing. Governments are implementing policies that encourage the adoption of wood-based products, recognizing their environmental benefits. In 2025, it is expected that more countries will introduce incentives for using renewable materials, which could lead to a significant uptick in market growth. Compliance with these regulations not only enhances market access but also fosters innovation among manufacturers. As companies adapt to these evolving standards, they are likely to develop new products that meet both consumer expectations and regulatory requirements, thereby strengthening their market position.

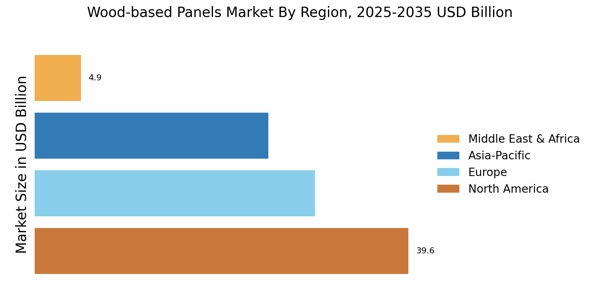

Urbanization Trends

Urbanization is a significant driver of the Wood-based Panels Market. As populations migrate towards urban centers, the demand for housing and commercial spaces escalates. This trend necessitates the use of wood-based panels in construction, as they provide lightweight yet sturdy solutions for building structures. In 2025, the construction sector is anticipated to account for a substantial portion of the wood-based panels market, with an estimated value of over 30 billion dollars. The versatility of wood-based panels makes them suitable for various applications, including flooring, walls, and furniture. Consequently, urbanization not only fuels demand but also encourages innovation in product design and functionality.

Consumer Preferences

Shifting consumer preferences are reshaping the Wood-based Panels Market. There is a growing inclination towards products that combine aesthetics with functionality. Consumers are increasingly seeking wood-based panels that offer unique designs, textures, and finishes, which can enhance the overall appeal of their living and working spaces. In 2025, the market is projected to see a rise in demand for customized wood-based solutions, as individuals and businesses look for ways to express their identity through interior design. This trend not only drives innovation in product offerings but also encourages manufacturers to invest in research and development to meet diverse consumer needs. As preferences evolve, the industry must remain agile to adapt to these changes.

Technological Innovations

Technological advancements play a pivotal role in shaping the Wood-based Panels Market. Innovations in manufacturing processes, such as automated production lines and advanced adhesives, enhance efficiency and product quality. In 2025, the market is expected to witness a surge in demand for engineered wood products, which are produced using cutting-edge technology. These products offer superior performance characteristics, such as increased durability and resistance to environmental factors. Furthermore, the integration of digital tools for design and customization allows manufacturers to cater to specific consumer needs, thereby expanding their market reach. As technology continues to evolve, it is likely to redefine production standards and consumer expectations.

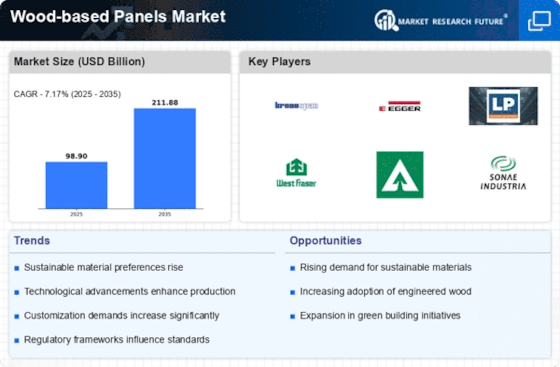

Sustainability Initiatives

The Wood-based Panels Market is increasingly influenced by sustainability initiatives. As consumers and businesses alike prioritize eco-friendly products, manufacturers are adapting their processes to meet these demands. The use of renewable resources, such as sustainably sourced timber, is becoming a standard practice. In 2025, the market is projected to grow at a compound annual growth rate of 4.5%, driven by the rising preference for environmentally responsible materials. This shift not only enhances brand reputation but also aligns with regulatory frameworks aimed at reducing carbon footprints. Companies that invest in sustainable practices are likely to gain a competitive edge, as they appeal to a growing demographic that values environmental stewardship.