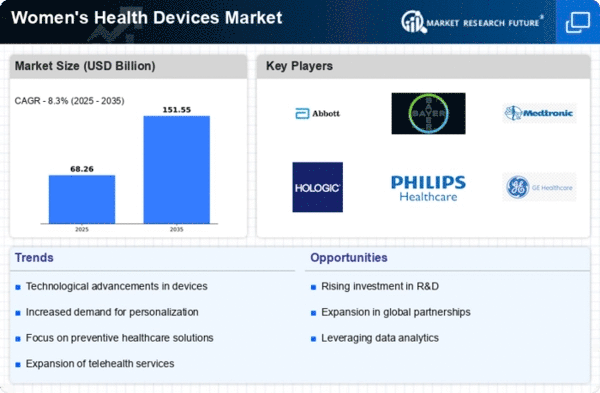

The Womens Health Devices Market is currently characterized by a dynamic competitive landscape, driven by innovation, technological advancements, and a growing emphasis on personalized healthcare solutions. Key players such as Abbott Laboratories (US), Hologic Inc. (US), and Siemens Healthineers (DE) are strategically positioning themselves through a combination of product innovation and strategic partnerships. These companies are focusing on enhancing their product portfolios to address the diverse needs of women's health, which includes reproductive health, diagnostics, and chronic disease management. Their collective strategies are shaping a competitive environment that is increasingly focused on delivering tailored solutions to improve patient outcomes.In terms of business tactics, companies are increasingly localizing manufacturing and optimizing supply chains to enhance efficiency and reduce costs. The market structure appears moderately fragmented, with several key players holding substantial market shares while also facing competition from emerging companies. This fragmentation allows for a variety of innovative solutions to emerge, as companies strive to differentiate themselves through unique offerings and improved service delivery.

In November Hologic Inc. (US) announced the launch of a new digital health platform aimed at enhancing the accessibility of women's health services. This platform integrates telehealth capabilities with traditional diagnostic tools, allowing for a more comprehensive approach to patient care. The strategic importance of this move lies in Hologic's commitment to leveraging technology to improve patient engagement and streamline healthcare delivery, which is increasingly vital in today's health landscape.

In October Siemens Healthineers (DE) expanded its partnership with a leading telemedicine provider to enhance remote monitoring capabilities for women's health. This collaboration aims to integrate advanced imaging technologies with telehealth services, thereby facilitating timely interventions and improving patient outcomes. The significance of this partnership is underscored by the growing demand for remote healthcare solutions, particularly in the context of women's health, where timely access to care can be critical.

In September Abbott Laboratories (US) unveiled a new line of wearable health monitoring devices specifically designed for women. These devices track various health metrics, including menstrual cycles and hormonal changes, providing users with personalized insights. This strategic initiative reflects Abbott's focus on innovation and its commitment to addressing the unique health needs of women, potentially positioning the company as a leader in this niche market.

As of December the competitive trends within the Womens Health Devices Market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence (AI). Strategic alliances are playing a crucial role in shaping the current landscape, as companies collaborate to enhance their technological capabilities and expand their market reach. Looking ahead, it is likely that competitive differentiation will evolve from traditional price-based competition to a focus on innovation, advanced technology, and reliable supply chains, as companies seek to meet the growing demand for personalized and efficient healthcare solutions.