Growing Demand for Premium Wines

The Wine Fining Agent Market is experiencing a notable increase in demand for premium wines, which often necessitates the use of fining agents to enhance clarity and stability. As consumers become more discerning, wineries are compelled to invest in quality improvement processes. This trend is reflected in the rising sales of high-end wines, with the premium segment projected to account for a substantial share of the overall wine market. The emphasis on quality has led to a greater reliance on effective fining agents, which can significantly influence the sensory attributes of the final product. Consequently, the Wine Fining Agent Market is likely to benefit from this shift towards premiumization, as producers seek to differentiate their offerings in a competitive landscape.

Regulatory Compliance and Quality Standards

The Wine Fining Agent Market is significantly influenced by stringent regulatory frameworks and quality standards imposed by various authorities. Compliance with these regulations is essential for wineries aiming to maintain market access and consumer trust. As regulations evolve, there is an increasing need for fining agents that meet specific safety and quality criteria. This has led to a surge in demand for certified fining agents that can ensure compliance while enhancing the overall quality of the wine. The emphasis on regulatory adherence is likely to drive innovation within the Wine Fining Agent Market, as manufacturers strive to develop products that align with these standards.

Technological Advancements in Fining Processes

Innovations in fining technologies are reshaping the Wine Fining Agent Market, enabling more efficient and effective clarification processes. The introduction of advanced fining agents, such as plant-based and synthetic alternatives, has expanded the options available to winemakers. These advancements not only improve the quality of the wine but also reduce the time and resources required for fining. Moreover, the integration of automation and precision techniques in the fining process is likely to enhance consistency and reduce waste. As wineries adopt these technologies, the demand for specialized fining agents is expected to rise, further propelling the growth of the Wine Fining Agent Market.

Rising Interest in Organic and Biodynamic Wines

The growing consumer interest in organic and biodynamic wines is reshaping the Wine Fining Agent Market. As more wineries adopt organic practices, there is a corresponding demand for fining agents that align with these principles. Organic fining agents, derived from natural sources, are increasingly favored by producers seeking to appeal to health-conscious consumers. This trend is reflected in the expanding market for organic wines, which has seen significant growth in recent years. The Wine Fining Agent Market is likely to adapt to this shift by offering a wider range of organic and natural fining solutions, catering to the evolving preferences of the wine market.

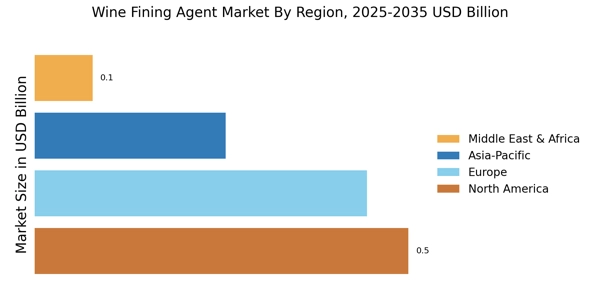

Expansion of Wine Production in Emerging Markets

The Wine Fining Agent Market is poised for growth due to the expansion of wine production in emerging markets. Countries that have traditionally been less prominent in wine production are now investing in vineyards and wineries, leading to an increased demand for fining agents. As these markets develop, there is a growing recognition of the importance of quality in wine production, which drives the need for effective fining solutions. This trend is expected to create new opportunities for suppliers within the Wine Fining Agent Market, as producers in these regions seek to enhance their offerings and compete on a larger scale.