Consumer Preferences

Consumer preferences are evolving within the Wine Cork Market, with a noticeable shift towards premium and organic wines. As wine enthusiasts seek higher quality experiences, the demand for natural cork closures is likely to increase. Research indicates that wines sealed with natural cork are often perceived as superior, enhancing the overall tasting experience. In 2024, it is projected that the market share of natural cork could reach 60%, reflecting a growing inclination towards authenticity and tradition in wine consumption. This trend may compel producers to prioritize cork sourcing and quality, thereby influencing the entire supply chain. The Wine Cork Market must adapt to these changing preferences to remain competitive and relevant.

Regulatory Compliance

Regulatory compliance is becoming increasingly critical in the Wine Cork Market, as governments implement stricter guidelines regarding food safety and environmental standards. Compliance with these regulations is essential for manufacturers to maintain market access and consumer trust. In 2023, approximately 30% of cork producers reported challenges in meeting new sustainability regulations, which has prompted many to invest in compliance strategies. This focus on regulation may drive innovation in sustainable practices and product development, as companies seek to align with governmental expectations. As the regulatory landscape evolves, the Wine Cork Market must remain vigilant and proactive in adapting to these changes to ensure long-term viability.

Technological Innovations

Technological innovations are reshaping the Wine Cork Market, particularly in the areas of production and quality control. Advanced manufacturing techniques, such as laser cutting and automated quality assessments, are enhancing the precision and consistency of cork products. These innovations not only improve the quality of cork closures but also increase production efficiency. In 2025, it is anticipated that the integration of smart technologies in cork production could reduce waste by up to 20%, thereby lowering costs. Furthermore, the development of synthetic cork alternatives is gaining traction, appealing to a segment of the market that prioritizes durability and consistency. As technology continues to advance, the Wine Cork Market is likely to experience significant transformations.

Sustainability Initiatives

The Wine Cork Market is increasingly influenced by sustainability initiatives. As consumers become more environmentally conscious, the demand for natural cork, which is biodegradable and renewable, is rising. This shift is evident as cork oak forests are recognized for their role in carbon sequestration, thus promoting biodiversity. In 2023, the market for natural cork products saw a growth rate of approximately 5%, driven by eco-friendly practices. Companies are investing in sustainable sourcing and production methods, which not only appeal to consumers but also align with regulatory frameworks aimed at reducing environmental impact. This trend suggests that sustainability will continue to be a pivotal driver in the Wine Cork Market, potentially leading to innovations in product offerings and marketing strategies.

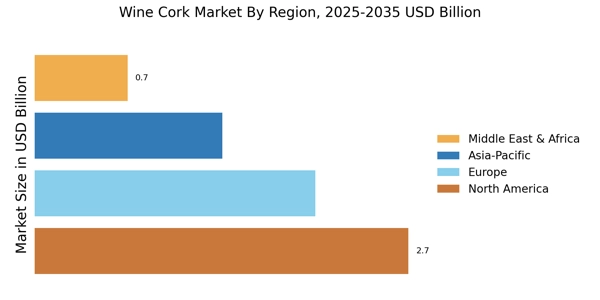

Market Expansion Opportunities

Market expansion opportunities are emerging within the Wine Cork Market, particularly in developing regions where wine consumption is on the rise. Countries in Asia and South America are witnessing a surge in wine production and consumption, creating a demand for cork closures. In 2024, it is estimated that the cork market in these regions could grow by 8%, driven by increasing disposable incomes and changing lifestyles. This expansion presents a unique opportunity for cork producers to tap into new markets and diversify their customer base. However, it also poses challenges in terms of logistics and supply chain management. The Wine Cork Market must strategically navigate these opportunities to capitalize on growth potential.