Regulatory Support and Policy Frameworks

The Wind Turbine Blade Recycling Market is significantly influenced by regulatory support and policy frameworks that promote sustainable waste management practices. Governments are increasingly recognizing the environmental impact of wind turbine blades, which are often made from composite materials that are difficult to recycle. As a response, various regulations are being implemented to encourage recycling initiatives and reduce landfill waste. For example, some regions have introduced mandates requiring manufacturers to develop end-of-life plans for their products. This regulatory landscape is expected to foster collaboration between stakeholders, including manufacturers, recyclers, and policymakers, thereby enhancing the overall recycling infrastructure. The market could see a boost in growth as compliance with these regulations becomes a priority for industry players.

Increased Awareness of Environmental Impact

The Wind Turbine Blade Recycling Market is also benefiting from increased awareness of the environmental impact associated with wind turbine blades. As the renewable energy sector expands, stakeholders are becoming more cognizant of the lifecycle of wind turbine components, particularly the challenges posed by blade disposal. This heightened awareness is prompting manufacturers and consumers alike to seek out sustainable solutions for end-of-life turbine blades. Educational campaigns and industry initiatives are playing a crucial role in disseminating information about the importance of recycling. As a result, there is a growing expectation for companies to adopt responsible practices, which could lead to a more robust recycling market. The emphasis on environmental stewardship is likely to drive innovation and investment in recycling technologies.

Emergence of Advanced Recycling Technologies

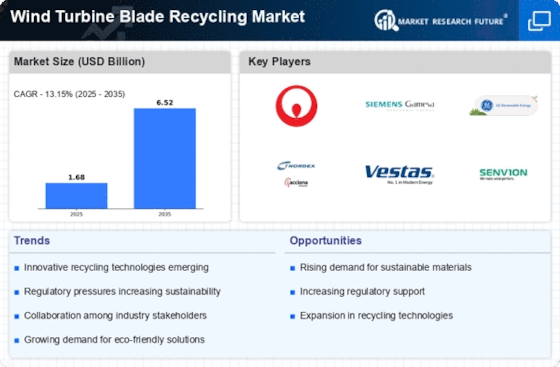

The Wind Turbine Blade Recycling Market is witnessing a notable shift due to the emergence of advanced recycling technologies. Innovations such as pyrolysis and chemical recycling are being developed to address the challenges posed by traditional mechanical recycling methods. These technologies not only enhance the efficiency of material recovery but also expand the range of materials that can be recycled. For instance, the ability to recover valuable fibers and resins from composite materials is becoming increasingly feasible. As a result, the market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. This technological advancement is likely to attract investments and drive the adoption of recycling practices within the industry.

Economic Incentives for Recycling Initiatives

The Wind Turbine Blade Recycling Market is poised for growth due to the economic incentives being introduced to promote recycling initiatives. Various financial mechanisms, such as subsidies and tax breaks, are being implemented by governments to encourage companies to invest in recycling technologies and infrastructure. These incentives not only lower the financial barriers associated with recycling but also enhance the economic viability of recycling operations. As the cost of raw materials continues to rise, the potential for recovering valuable materials from decommissioned turbine blades becomes increasingly attractive. This economic rationale is likely to stimulate interest in the recycling market, as businesses recognize the dual benefits of environmental responsibility and cost savings. The combination of economic incentives and growing market demand could lead to a more sustainable future for wind turbine blade recycling.

Growing Demand for Sustainable Energy Solutions

The Wind Turbine Blade Recycling Market is experiencing a surge in demand for sustainable energy solutions, driven by the global transition towards renewable energy sources. As countries strive to meet their climate goals, the deployment of wind energy is increasing, leading to a rise in the number of wind turbines installed. Consequently, the need for effective recycling solutions for turbine blades is becoming more pressing. It is estimated that by 2030, the number of decommissioned wind turbine blades could reach over 40,000, creating a substantial market opportunity for recycling services. This growing demand for sustainable practices not only aligns with environmental objectives but also presents economic opportunities for businesses engaged in the recycling sector.