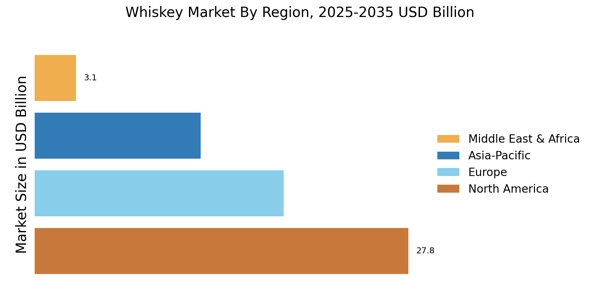

North America : Whiskey Market's Thriving Market

North America remains the largest market for whiskey, accounting for approximately 45% of global consumption. The growth is driven by increasing demand for premium and craft whiskey, alongside a rising trend in cocktail culture. The Us Whiskey Market is witnessing a profound shift toward "purposeful drinking," where consumers prioritize craft transparency and authentic heritage over high-volume consumption. Regulatory support, such as reduced tariffs on imported spirits, has further catalyzed market expansion. The U.S. leads this region, followed closely by Canada, which holds about 15% of the market share. The competitive landscape is dominated by major players like Brown-Forman and Diageo, who are investing heavily in marketing and product innovation. The U.S. market is characterized by a diverse range of whiskey styles, including bourbon and rye, appealing to a broad consumer base. Craft distilleries are also gaining traction, contributing to the dynamic market environment. The presence of established brands and new entrants fosters a competitive yet collaborative atmosphere.

Europe : Heritage and Innovation Combined

Europe, particularly the UK and Ireland, is a significant player in the whiskey market, holding around 30% of global consumption. The region benefits from a rich heritage of whiskey production, with increasing interest in artisanal and craft distilleries. Regulatory frameworks, such as the EU's geographical indications, protect traditional whiskey production methods, enhancing market value. The UK is the largest market in Europe, followed by Ireland, which has seen a resurgence in whiskey exports. Leading countries like Scotland and Ireland are home to renowned brands such as Chivas Brothers and William Grant & Sons. The competitive landscape is marked by a blend of established brands and emerging craft distilleries, fostering innovation. The European market is also witnessing a rise in whiskey tourism, attracting enthusiasts and contributing to local economies. This combination of tradition and modernity positions Europe as a key player in The Whiskey Market.

Asia-Pacific : Emerging Markets on the Rise

The Asia-Pacific region is rapidly emerging as a significant market for whiskey, accounting for approximately 20% of global consumption. Countries like Japan and India are leading this growth, driven by increasing disposable incomes and a growing interest in premium spirits. Regulatory changes, such as reduced import duties on whiskey, have also facilitated market expansion. The China Whiskey Market is undergoing a domestic revolution as international spirits giants open large-scale distilleries within the country to produce "Eastern character" malts. The whiskey market in India has become a global powerhouse, with home-grown single malts now gaining international acclaim and challenging established Scotch brands.

Japan is the largest market in this region, with India following closely behind, contributing to the dynamic landscape of whiskey consumption. The competitive environment is characterized by both local and international players, including Suntory Holdings and Beam Suntory. Japanese whiskey, known for its craftsmanship, has gained global acclaim, while Indian brands are expanding their footprint internationally. The region's diverse consumer preferences are prompting brands to innovate and adapt, creating a vibrant market atmosphere that is attracting investment and interest from global players. The Global Whiskey Market Size continues to expand as emerging middle-class populations in Asia and Latin America adopt Western-style premium spirits.

Middle East and Africa : Cultural Shifts in Spirits Consumption

The Middle East and Africa region is witnessing a gradual increase in whiskey consumption, holding about 5% of the global market. This growth is primarily driven by changing cultural attitudes towards alcohol consumption and a burgeoning middle class with increased purchasing power. Countries like South Africa and the UAE are leading this trend, supported by regulatory changes that are becoming more favorable towards alcohol sales. South Africa is the largest market in the region, with the UAE following closely behind. The competitive landscape features a mix of international brands and local distilleries, with key players like Morrison Bowmore Distillers making their mark. The region's unique cultural dynamics are influencing consumer preferences, leading to a growing interest in premium and imported whiskey. As the market evolves, brands are focusing on tailored marketing strategies to appeal to diverse consumer segments, enhancing their presence in this emerging market.