Whiskey Size

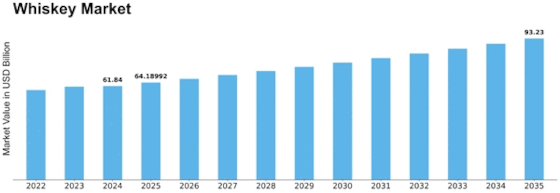

Whiskey Market Growth Projections and Opportunities

The Whiskey Market is influenced by a range of factors that collectively define its dynamics and growth patterns. One of the primary drivers of this market is the evolving consumer preferences and a growing appreciation for premium and craft spirits. As consumers seek unique and high-quality alcoholic beverages, there has been a notable surge in the demand for premium and artisanal whiskeys. This trend is driven by a desire for distinct flavors, craftsmanship, and the storytelling aspect associated with small-batch and craft whiskey production.

Changing demographics and lifestyle choices also contribute significantly to the whiskey market's growth. Younger consumers, in particular, are increasingly drawn to whiskey as their drink of choice, shifting away from traditional preferences. This demographic shift, coupled with the influence of popular culture and the rise of cocktail culture, has led to an expanding consumer base for whiskey products. As a versatile spirit, whiskey has found its place in a variety of cocktails, attracting a broader audience.

The global trend towards experiential consumption plays a pivotal role in shaping the whiskey market. Consumers are not just buying a product; they are seeking an experience, and whiskey, with its rich history, diverse expressions, and sophisticated tasting notes, provides a multisensory experience for enthusiasts. Distillery tours, tastings, and whiskey-themed events contribute to this experiential aspect, fostering brand loyalty and a deeper connection between consumers and the products they choose.

The impact of regional and cultural influences is evident in the whiskey market. Different regions, such as Scotland, Ireland, the United States, and Japan, have distinct whiskey traditions and production methods, each contributing to a diverse range of whiskey styles. Consumer preferences for specific whiskey types, such as Scotch, Bourbon, or Rye, are often influenced by these regional traditions, creating a dynamic and varied market landscape.

Technological advancements and innovations in whiskey production also play a role in the market's evolution. From traditional distillation methods to experimentation with cask types and aging processes, distillers continuously explore new ways to create unique and innovative whiskey expressions. Additionally, digital platforms and e-commerce have transformed the way consumers discover and purchase whiskey, providing them with a broader selection and convenient access to rare and limited-edition releases.

Market competition and the presence of established and emerging brands contribute to the whiskey industry's vibrancy. Distilleries compete not only in terms of product quality but also in branding, marketing, and storytelling. The introduction of limited-edition releases, collaborations, and innovative packaging further intensify competition, catering to the diverse preferences and expectations of consumers.

Government regulations and trade policies related to alcohol production and distribution significantly impact the whiskey market. Compliance with age restrictions, labeling requirements, and taxation policies is crucial for both domestic and international trade. Additionally, geopolitical factors, such as trade agreements and tariffs, influence the global movement of whiskey products and can impact pricing and availability.

Leave a Comment