Advancements in Sensor Technology

The Weigh In Motion Market is benefiting from rapid advancements in sensor technology, which enhance the accuracy and reliability of weight measurements. Innovations in sensor design, such as the development of more sensitive and durable sensors, are enabling weigh in motion systems to operate effectively under various environmental conditions. This technological evolution is likely to attract new players into the market, fostering competition and driving down costs. As a result, the Weigh In Motion Market may experience a significant uptick in adoption rates, with forecasts indicating a potential growth of 10% in the next few years as more organizations recognize the advantages of modern sensor technologies.

Integration with Smart City Initiatives

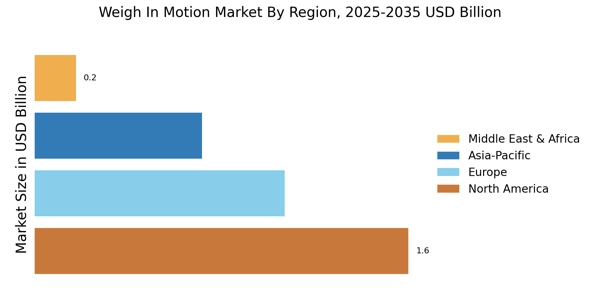

The Weigh In Motion Market is poised for growth due to the integration of weigh in motion technologies with smart city initiatives. As cities evolve into smart environments, the need for efficient traffic management systems becomes paramount. Weigh in motion systems can provide valuable data that supports intelligent transportation systems, enhancing traffic flow and reducing congestion. This integration is likely to attract investments in weigh in motion technologies, as municipalities seek to leverage data analytics for improved urban mobility. The market could see a rise in demand for these systems, with estimates suggesting a potential increase of 20% in adoption rates as smart city projects gain momentum.

Growing Focus on Infrastructure Investment

The Weigh In Motion Market is being propelled by an increasing focus on infrastructure investment across various regions. Governments are recognizing the need to upgrade and maintain transportation infrastructure to support economic growth and public safety. Weigh in motion systems play a critical role in this context, as they provide essential data for infrastructure planning and maintenance. The market is likely to benefit from substantial public and private investments in transportation projects, with estimates suggesting that infrastructure spending could rise by 12% in the next few years. This trend indicates a robust opportunity for the Weigh In Motion Market to expand as stakeholders seek to enhance their infrastructure capabilities.

Increased Demand for Accurate Traffic Data

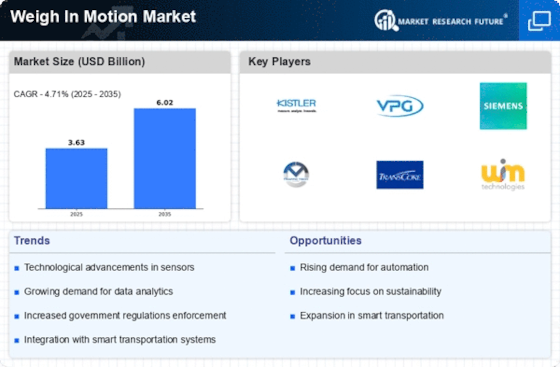

The Weigh In Motion Market is experiencing a surge in demand for precise traffic data collection. As urbanization accelerates, municipalities and transportation agencies require accurate information on vehicle weights and traffic patterns to enhance road safety and infrastructure planning. The integration of weigh in motion systems allows for real-time data acquisition, which is crucial for effective traffic management. According to recent statistics, the need for reliable traffic data has led to a projected growth rate of approximately 8% in the Weigh In Motion Market over the next five years. This trend indicates a growing recognition of the importance of data-driven decision-making in transportation management.

Regulatory Compliance and Safety Standards

The Weigh In Motion Market is significantly influenced by stringent regulatory frameworks aimed at ensuring road safety and compliance with weight limits. Governments worldwide are implementing laws that mandate the use of weigh in motion systems to monitor vehicle weights, thereby reducing the risk of road damage and accidents caused by overloaded vehicles. This regulatory push is expected to drive market growth, as companies invest in advanced weigh in motion technologies to meet compliance requirements. The market is projected to expand as more jurisdictions adopt these regulations, potentially increasing the adoption rate of weigh in motion systems by 15% in the coming years.