Tokenization of Assets

The Global Web3 in Retail Market Industry is experiencing a surge in the tokenization of assets, which allows physical goods to be represented as digital tokens on a blockchain. This innovation facilitates fractional ownership and enhances liquidity for retail products. For instance, luxury brands are exploring tokenization to offer exclusive ownership experiences to consumers. As this trend gains traction, it is anticipated that the market will achieve a compound annual growth rate of 58.69% from 2025 to 2035. This growth may lead to a more dynamic retail landscape where consumers can invest in and trade tokenized assets seamlessly.

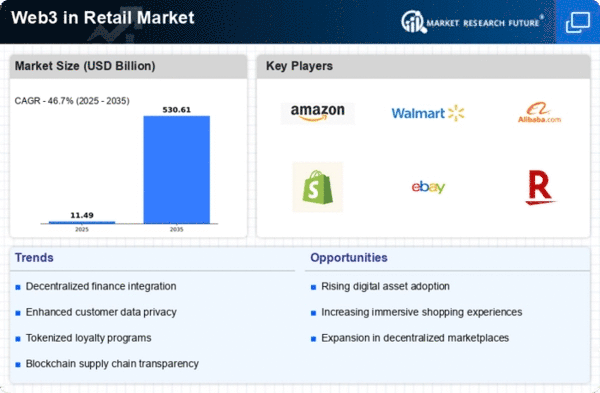

Market Growth Projections

The Global Web3 in Retail Market Industry is poised for remarkable growth, with projections indicating a rise from 3.3 USD Billion in 2024 to 530.6 USD Billion by 2035. This trajectory suggests a compound annual growth rate of 58.69% from 2025 to 2035, reflecting the increasing adoption of Web3 technologies across the retail sector. Factors contributing to this growth include the decentralization of transactions, enhanced customer experiences, and the integration of advanced technologies such as AI and blockchain. As retailers continue to innovate and adapt to changing consumer preferences, the market is likely to expand significantly in the coming years.

Supply Chain Transparency

Supply chain transparency is becoming increasingly critical in the Global Web3 in Retail Market Industry. By utilizing blockchain technology, retailers can provide consumers with verifiable information about product origins, manufacturing processes, and sustainability practices. This transparency not only builds consumer trust but also aligns with the growing demand for ethical consumption. As retailers adopt these technologies, they are likely to differentiate themselves in a competitive market. The emphasis on transparency is expected to contribute to the projected market growth, as consumers increasingly seek brands that prioritize ethical practices and sustainability.

Enhanced Customer Experience

In the Global Web3 in Retail Market Industry, enhancing customer experience is paramount. Retailers are increasingly leveraging Web3 technologies to create personalized shopping experiences through data ownership and privacy. For example, customers can control their data and choose how it is shared, fostering trust and loyalty. This shift is expected to drive market growth, with projections indicating a rise to 530.6 USD Billion by 2035. As retailers adopt immersive technologies such as augmented reality and virtual reality, they are likely to create engaging environments that resonate with consumers, thus enhancing overall satisfaction and retention.

Decentralization of Transactions

The Global Web3 in Retail Market Industry is witnessing a notable shift towards decentralized transactions. This transformation allows retailers to bypass traditional intermediaries, thereby reducing transaction costs and enhancing efficiency. For instance, blockchain technology enables peer-to-peer transactions, which can lead to faster settlements and increased trust among consumers. As a result, the market is projected to reach 3.3 USD Billion in 2024, reflecting a growing preference for decentralized solutions. This trend is likely to continue as more retailers adopt blockchain platforms, potentially revolutionizing the way transactions are conducted in the retail sector.

Integration of Artificial Intelligence

The integration of artificial intelligence within the Global Web3 in Retail Market Industry is reshaping how retailers operate. AI technologies are being employed to analyze consumer behavior, optimize inventory management, and enhance marketing strategies. This data-driven approach allows retailers to make informed decisions and tailor their offerings to meet consumer demands effectively. As AI continues to evolve, its synergy with Web3 technologies is likely to drive innovation in the retail sector. The combination of AI and blockchain could lead to more efficient operations and improved customer engagement, further propelling market growth.