Expansion of Applications Beyond Fitness

The Wearable Motion Sensors Market is witnessing an expansion of applications beyond traditional fitness tracking. Industries such as healthcare, automotive, and gaming are increasingly incorporating wearable motion sensors into their products. For example, in healthcare, these sensors are being used for rehabilitation and monitoring patients' movements. The automotive sector is exploring their use in driver assistance systems. This diversification of applications is expected to drive market growth, as it opens new revenue streams and encourages innovation in sensor technology, potentially leading to a market valuation exceeding 50 billion dollars by 2030.

Increased Adoption in Sports and Fitness

The sports and fitness sector is increasingly adopting wearable motion sensors, which is propelling the Wearable Motion Sensors Market. Athletes and fitness enthusiasts are utilizing these devices to optimize their performance and monitor their training regimens. The market for sports wearables is anticipated to reach over 15 billion dollars by 2025, driven by the need for precise performance metrics and injury prevention. This trend suggests that as more individuals engage in fitness activities, the demand for wearable motion sensors will likely continue to rise, fostering innovation and competition among manufacturers.

Growing Interest in Smart Home Integration

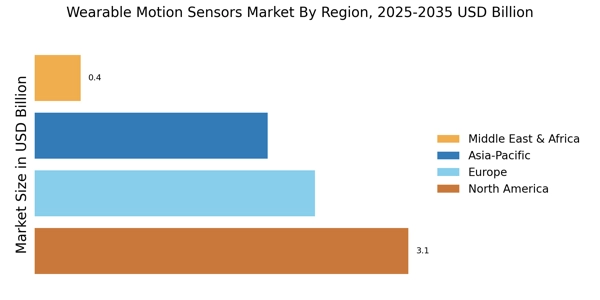

The trend towards smart home technology is influencing the Wearable Motion Sensors Market. As consumers increasingly seek interconnected devices, the integration of wearable motion sensors with smart home systems is becoming more prevalent. This synergy allows for enhanced user experiences, such as automated home settings based on user activity levels. The market for smart home devices is projected to grow significantly, which may lead to increased demand for compatible wearable motion sensors. This integration not only enhances convenience but also positions wearable technology as a vital component of the smart home ecosystem.

Rising Demand for Health Monitoring Solutions

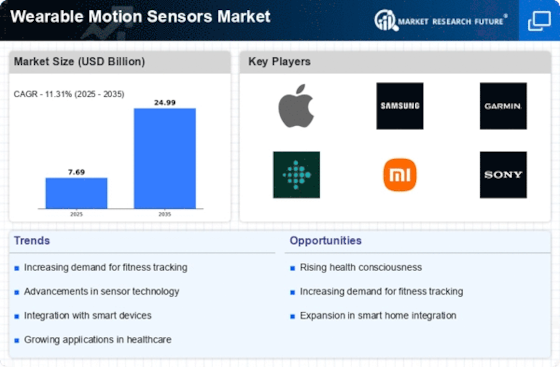

The increasing awareness of health and wellness is driving the Wearable Motion Sensors Market. Consumers are increasingly seeking devices that can monitor their physical activity, heart rate, and sleep patterns. This trend is reflected in the projected growth of the health and fitness segment, which is expected to reach a valuation of approximately 30 billion dollars by 2026. As individuals become more health-conscious, the demand for wearable motion sensors that provide real-time data and insights is likely to surge. This shift not only enhances personal health management but also encourages manufacturers to innovate and improve their offerings, thereby expanding the Wearable Motion Sensors Market.

Technological Advancements in Sensor Technology

Technological innovations are significantly influencing the Wearable Motion Sensors Market. Advances in sensor technology, such as miniaturization and improved accuracy, are enabling the development of more sophisticated wearable devices. For instance, the integration of advanced algorithms and machine learning capabilities allows for more precise motion tracking and data analysis. This evolution is expected to enhance user experience and broaden the application scope of wearable motion sensors. As a result, the market is projected to grow at a compound annual growth rate of around 20% over the next five years, indicating a robust demand for cutting-edge wearable technology.