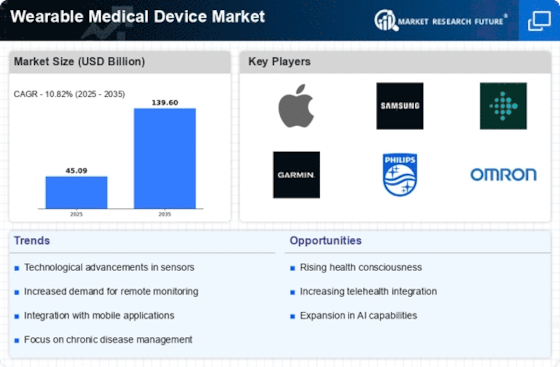

Growing Awareness of Health and Fitness

There is a notable increase in health consciousness among consumers, which is significantly influencing the Wearable Medical Device Market. As individuals become more aware of the importance of maintaining a healthy lifestyle, the demand for wearable devices that monitor physical activity, heart rate, and sleep patterns is surging. Market Research Future indicates that the fitness tracker segment is experiencing robust growth, with consumers seeking devices that provide real-time feedback on their health metrics. This heightened awareness not only drives sales of fitness-oriented wearables but also encourages manufacturers to innovate and improve their offerings. Consequently, the market is witnessing a diversification of products aimed at various demographics, including older adults who may benefit from health monitoring features. This trend suggests a long-term shift towards integrating wearable technology into daily health routines.

Rising Demand for Remote Patient Monitoring

The increasing prevalence of chronic diseases has led to a rising demand for remote patient monitoring solutions within the Wearable Medical Device Market. As healthcare systems strive to enhance patient outcomes while reducing costs, wearable devices that facilitate continuous monitoring of vital signs are becoming essential. According to recent data, the market for remote patient monitoring devices is projected to grow significantly, driven by the need for efficient management of conditions such as diabetes and cardiovascular diseases. This trend indicates a shift towards more proactive healthcare approaches, where patients can be monitored in real-time, allowing for timely interventions and reducing hospital readmissions. Consequently, the integration of wearable medical devices into everyday healthcare practices is likely to expand, reflecting a broader acceptance of technology in managing health.

Regulatory Support for Wearable Technologies

Regulatory support is emerging as a crucial driver for the Wearable Medical Device Market. As wearable technologies gain traction, regulatory bodies are beginning to establish frameworks that facilitate the approval and integration of these devices into healthcare systems. This support not only enhances consumer confidence but also encourages manufacturers to invest in the development of compliant and safe wearable medical devices. Recent initiatives by regulatory agencies to streamline the approval process for wearable technologies indicate a commitment to fostering innovation while ensuring patient safety. Market data suggests that as regulations become more favorable, the adoption of wearable medical devices is likely to increase, leading to a more robust market environment. This regulatory landscape may also encourage collaboration between technology developers and healthcare providers, further enhancing the potential of wearable devices in clinical settings.

Increased Investment in Healthcare Technology

Investment in healthcare technology is witnessing a significant uptick, which is positively impacting the Wearable Medical Device Market. Governments and private entities are increasingly allocating funds towards the development and deployment of innovative healthcare solutions, including wearable devices. This influx of capital is facilitating research and development efforts, leading to the introduction of advanced wearable technologies that cater to diverse health needs. Market data indicates that the wearable medical device sector is expected to attract substantial investments, driven by the potential for improved patient outcomes and cost savings in healthcare delivery. As stakeholders recognize the value of wearable devices in enhancing patient engagement and monitoring, the market is likely to experience accelerated growth, fostering a competitive landscape that encourages continuous innovation.

Technological Advancements in Wearable Devices

Technological advancements play a pivotal role in shaping the Wearable Medical Device Market. Innovations such as miniaturization of sensors, improved battery life, and enhanced connectivity options are driving the development of more sophisticated wearable devices. For instance, the integration of artificial intelligence and machine learning algorithms into these devices allows for more accurate health data analysis and personalized health insights. Market data suggests that the adoption of smart wearables, which can track a wide range of health metrics, is on the rise. This trend not only enhances user experience but also encourages greater engagement in personal health management. As technology continues to evolve, the capabilities of wearable medical devices are expected to expand, potentially leading to new applications in preventive healthcare and chronic disease management.