Regulatory Support and Standardization

Regulatory support and standardization play a pivotal role in shaping the wearable medical-device market. The U.S. Food and Drug Administration (FDA) has been actively working to streamline the approval process for wearable devices, encouraging innovation while ensuring safety and efficacy. This regulatory environment fosters consumer trust and encourages manufacturers to invest in developing new technologies. As of 2025, the FDA's initiatives are expected to facilitate the entry of more advanced wearable devices into the market, potentially increasing market size by 20% over the next few years. Such support is crucial for the sustained growth of the industry.

Rising Health Awareness Among Consumers

In recent years, there has been a notable increase in health awareness among consumers, significantly impacting the wearable medical-device market. Individuals are becoming more proactive about their health, seeking devices that can provide insights into their physical well-being. This trend is reflected in the growing sales of fitness trackers and smartwatches, which have seen a rise of over 25% in unit sales in the past year alone. As consumers prioritize preventive health measures, the demand for wearable devices that monitor vital signs and provide health-related feedback is likely to continue to grow, further propelling the market.

Increased Investment in Health Technology

Investment in health technology is a crucial driver for the wearable medical-device market. Venture capital funding and government grants are increasingly directed towards innovative health solutions, including wearable devices. In 2025, investments in health tech are expected to exceed $15 billion, with a significant portion allocated to wearable medical devices. This influx of capital fosters innovation and accelerates the development of new products, enhancing the competitive landscape. As companies strive to differentiate their offerings, the market is likely to witness a surge in novel features and improved functionalities, catering to diverse consumer needs.

Technological Advancements in Wearable Devices

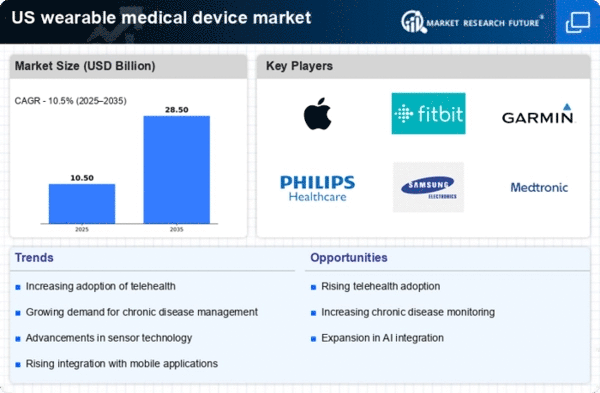

The wearable medical-device market is experiencing rapid growth due to continuous technological advancements. Innovations in sensor technology, battery life, and data analytics are enhancing the functionality of these devices. For instance, the integration of artificial intelligence (AI) and machine learning algorithms allows for more accurate health monitoring and predictive analytics. As of 2025, the market is projected to reach approximately $30 billion, driven by the increasing demand for real-time health data. These advancements not only improve user experience but also expand the range of applications, from chronic disease management to fitness tracking, thereby attracting a broader consumer base.

Aging Population and Chronic Disease Prevalence

The aging population in the United States is a significant factor influencing the wearable medical-device market. As the demographic shifts, there is a corresponding increase in chronic diseases such as diabetes and cardiovascular conditions. By 2025, it is estimated that over 60% of adults aged 65 and older will manage at least one chronic condition. This demographic shift creates a heightened demand for wearable devices that can monitor health metrics and provide timely alerts. Consequently, the market is poised for growth as these devices become essential tools for managing health in an aging society.