Market Share

Wave and Tidal Energy Market Share Analysis

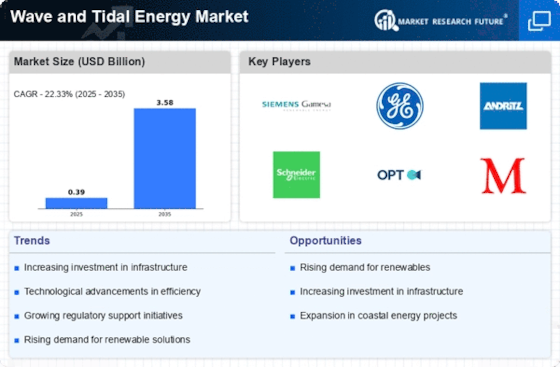

The wave and tidal energy market is gradually growing as a frontier in the renewable sector landscape, attracting companies which apply different strategies concerning their position of share within this field. A popular technique is technology differentiation where companies engage in developing leading-edge technologies to mark their distinction. Through investment in research and development, these companies can design more effective wave and tidal energy solutions that are lower costing by market share. Moreover, strategic partnerships are very important components of market positioning within the wave and tidal energy industry. Compliance through collaboration with government agencies, research institutions and other industry partners enables the leverage of resources which lead to a faster project development stage. Collaborations like these not only increase a company’s reputation but also improve its chances of obtaining funding and regulatory approval, enabling it to succeed in the highly regulated market for renewable energy. Additionally, the concept of market share strategies is geographic positioning. Companies have chosen carefully the locations to their wave and tidal energy projects depending on such parameters as resource demand, grid closeness including presence of appropriate environments for this marine power. Companies could gain a competitive advantage by managing to establish themselves in areas of the world with high demand for energy and favorable conditions suitable for wave and tidal power generation. The cost competitiveness of the wave and tidal energy sector is an important determinant of market share. Companies strive to reduce the expenses involved in constructing and sustaining wave-and-tidal energy projects. This cost reduction strategy is an essential tactic to make renewable energy solutions more attractive for investors and end users thus increasing market share. By managing projects effectively and finding new ways of cutting costs, companies that achieve economies of scale become market leaders. Apart from cost considerations, effective marketing and outreach efforts form an integral part of market share positioning. Recognition of the environmental and economic advantages that wave as well tidal power provides is necessary. Economic support of a company is premised on the ability to communicate its value proposition promoting trust in order achieve greater market share. In addition, regulatory involvement and compliance are essential portions of market share strategies in the realm of wave and tidal energy.

Leave a Comment