Rising Security Concerns

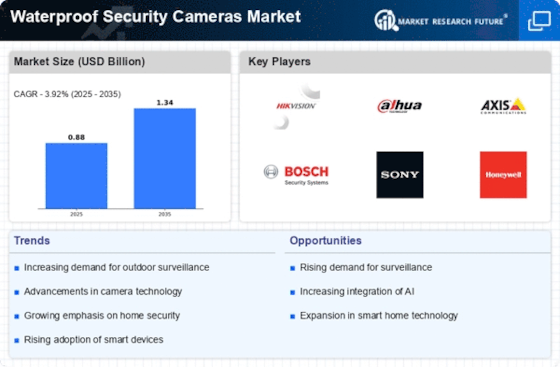

The increasing prevalence of crime and vandalism has heightened the demand for effective surveillance solutions, particularly in residential and commercial sectors. As safety becomes a paramount concern, the Waterproof Security Cameras Market is witnessing a surge in demand. According to recent data, the market is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is driven by the need for reliable security systems that can withstand harsh weather conditions, ensuring continuous monitoring. Consumers are increasingly investing in waterproof security cameras to protect their properties from theft and damage, indicating a shift towards more robust security measures. The waterproof feature not only enhances durability but also expands the range of installation options, making these cameras suitable for various environments.

Technological Innovations

Technological advancements play a crucial role in shaping the Waterproof Security Cameras Market. Innovations such as high-definition video quality, night vision capabilities, and remote access features are becoming standard in modern security cameras. The integration of artificial intelligence and machine learning is further enhancing the functionality of these devices, allowing for advanced motion detection and facial recognition. As these technologies evolve, they are likely to attract a broader consumer base, including both residential and commercial users. The market is expected to see a significant increase in the adoption of smart waterproof cameras, which can be controlled via mobile applications. This trend suggests that consumers are seeking more sophisticated security solutions that offer convenience and enhanced monitoring capabilities.

Growth in Smart Home Integration

The trend towards smart home integration is significantly influencing the Waterproof Security Cameras Market. As more households adopt smart home technologies, the demand for compatible security systems is on the rise. Waterproof security cameras that can seamlessly integrate with existing smart home ecosystems are particularly appealing to consumers. This integration allows for centralized control and monitoring, enhancing user experience and security. Market data indicates that the smart home market is expected to reach a valuation of over 150 billion by 2025, which will likely drive further growth in the waterproof security camera segment. Consumers are increasingly looking for solutions that not only provide security but also enhance the overall functionality of their smart homes, indicating a shift towards interconnected devices.

Regulatory Compliance and Standards

Regulatory compliance and industry standards are becoming increasingly important in the Waterproof Security Cameras Market. Governments and regulatory bodies are establishing guidelines to ensure that security cameras meet specific performance and safety criteria. This trend is pushing manufacturers to innovate and improve their products to comply with these regulations. As a result, consumers are more likely to invest in waterproof security cameras that adhere to recognized standards, ensuring reliability and effectiveness. The emphasis on compliance is expected to drive market growth, as consumers prioritize products that offer proven performance in various environmental conditions. This focus on standards not only enhances consumer trust but also encourages manufacturers to invest in research and development, leading to better products in the market.

Increased Awareness of Environmental Sustainability

The growing awareness of environmental sustainability is influencing consumer choices in the Waterproof Security Cameras Market. As consumers become more environmentally conscious, they are seeking products that are not only effective but also eco-friendly. Manufacturers are responding by developing waterproof security cameras that utilize sustainable materials and energy-efficient technologies. This shift towards sustainability is likely to attract a new segment of environmentally aware consumers, further expanding the market. Data suggests that products with eco-friendly certifications are increasingly preferred, indicating a potential shift in purchasing behavior. The emphasis on sustainability may also encourage manufacturers to innovate, leading to the development of more efficient and environmentally friendly security solutions.