Increasing Crime Rates

The security cameras market is experiencing growth due to rising crime rates across various urban areas in the US. As communities face challenges related to theft, vandalism, and other criminal activities, the demand for surveillance solutions has surged. According to recent data, property crime rates have increased by approximately 5% in major cities, prompting both residential and commercial sectors to invest in security cameras. This trend indicates a heightened awareness of safety and security, leading to a robust market for security cameras. Homeowners and businesses are increasingly recognizing the value of surveillance systems in deterring crime and providing evidence in case of incidents. Consequently, The security cameras market is likely to expand. More individuals and organizations are prioritizing their safety and security needs.

Technological Advancements

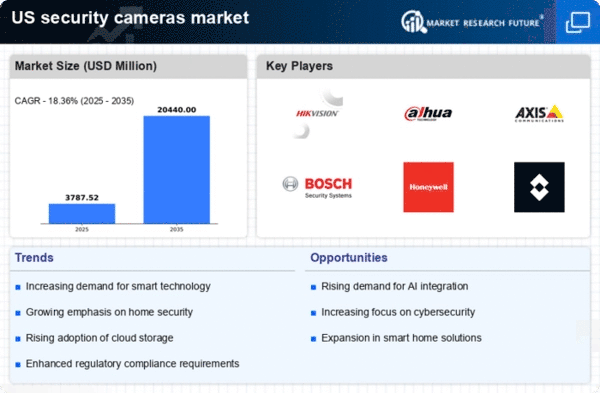

Technological advancements play a pivotal role in shaping the security cameras market. Innovations such as high-definition video quality, cloud storage solutions, and remote access capabilities are enhancing the functionality of security cameras. The integration of features like motion detection, night vision, and two-way audio is making these devices more appealing to consumers. In 2025, it is estimated that the market for smart security cameras will reach approximately $5 billion, reflecting a compound annual growth rate (CAGR) of around 10% over the next few years. These advancements not only improve the user experience but also increase the effectiveness of surveillance systems in various settings, from homes to businesses. As technology continues to evolve, the security cameras market is expected to witness further growth driven by consumer demand for more sophisticated and reliable security solutions.

Growing Awareness of Security

The growing awareness of security issues among consumers is significantly impacting the security cameras market. As individuals become more informed about the potential risks associated with inadequate security measures, there is a noticeable shift towards investing in surveillance systems. Surveys indicate that approximately 70% of homeowners now consider security cameras a necessary component of their home security strategy. This heightened awareness is not limited to residential properties; businesses are also recognizing the importance of surveillance in protecting assets and ensuring employee safety. The security cameras market is likely to benefit from this trend. More consumers are prioritizing security solutions that offer peace of mind. This shift in perception is expected to drive demand for a variety of security camera options, from basic models to advanced systems with integrated smart technology.

Regulatory Compliance Requirements

Regulatory compliance requirements are increasingly influencing the security cameras market. Various industries, including retail, healthcare, and finance, are subject to stringent regulations regarding surveillance and data protection. As organizations strive to comply with these regulations, the demand for security cameras that meet specific standards is on the rise. For instance, the implementation of the General Data Protection Regulation (GDPR) has prompted businesses to adopt more robust surveillance systems to ensure compliance. This trend is likely to continue, as companies recognize the importance of adhering to legal requirements while also enhancing their security measures. The security cameras market is expected to grow. Businesses are investing in compliant surveillance solutions that not only protect their assets but also align with regulatory standards.

Expansion of E-commerce and Retail Security

The expansion of e-commerce is driving the security cameras market, particularly in the retail sector. As online shopping continues to grow, brick-and-mortar stores are increasingly investing in surveillance systems to protect their physical locations. Retailers are facing challenges related to theft and fraud, leading to a heightened focus on security measures. In 2025, it is projected that retail theft will cost businesses over $60 billion annually, underscoring the need for effective surveillance solutions. The security cameras market is likely to benefit from this trend, as retailers seek to implement advanced security systems that deter theft and enhance overall safety. This shift towards prioritizing security in retail environments is expected to contribute to the ongoing growth of the security cameras market.