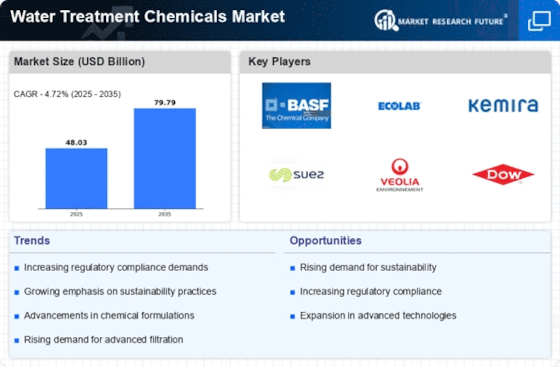

Top Industry Leaders in the Water Treatment Chemicals Market

The water treatment chemicals market is a hidden titan, quietly ensuring the very essence of life flows clean and pure. Valued at an estimated to this market is bubbling with potential, driven by a growing global population, increasing urbanization, and stricter environmental regulations. But behind the scenes, a fierce competition plays out, with established giants and agile newcomers battling for market share.

Market Overview and Share Drivers:

Water treatment chemicals play a crucial role in purifying water for various purposes, from municipal water supply to industrial processes. These chemicals include coagulants and flocculants for removing impurities, disinfectants for eliminating harmful microorganisms, corrosion inhibitors to protect infrastructure, and scale inhibitors to prevent mineral buildup.

Several factors influence market share in this dynamic landscape:

-

Product portfolio and innovation: Offering a diverse range of chemicals catering to specific water treatment needs and developing innovative solutions for emerging challenges keeps companies ahead of the curve. -

Geographical reach and production capacity: Having a strong global presence and efficient production facilities ensure timely supply and cater to regional demands. -

Sustainability initiatives: With environmental concerns at the forefront, developing eco-friendly chemicals and minimizing production footprints attract both customers and regulators. -

Cost competitiveness: Optimizing production processes and securing raw materials at competitive prices are crucial in this cost-sensitive market. -

Partnerships and collaborations: Joining forces with research institutions, technology providers, and water treatment service companies fosters innovation and expands market reach.

Competitive Strategies: Crystallizing Success

In this turbulent market, companies are deploying various strategies to gain an edge:

-

Mergers and acquisitions: Consolidation is evident, with giants like Ecolab Inc. and Suez S.A. acquiring smaller players to expand their product offerings and geographical reach. -

Focus on niche markets: Targeting specific industries, such as oil and gas or power generation, with tailored chemical solutions can secure a strong foothold. -

Investments in R&D: Developing new and improved chemicals, particularly for wastewater treatment and water reuse, fuels market growth and opens new avenues. -

Digitalization and automation: Implementing AI-powered water treatment monitoring and chemical dosing systems improves efficiency and optimizes resource utilization. -

Building strong customer relationships: Providing technical support, customized solutions, and after-sales services fosters customer loyalty and repeat business.

Key Players:

-

BASF SE (Germany)

-

Kemira OYJ (Finland)

-

Lanxess (Germany)

-

DuPont (US)

-

Akzo Nobel NV (Netherlands)

-

Solenis LLC (US)

-

Ecolab Inc (US)

-

Baker Hughes (US)

-

Suez SA (France)

-

Lonza Group (Switzerland)

Recent Developments:

November 2021: The expansion of Kemira's production capacity in the UK has now been fully completed, the company stated. The company will produce more than 100,000 tons more ferric-based water treatment chemicals each year at its facilities in the UK.

June 2021: To better serve the expanding Asia-Pacific market, Kemira announced two investments to increase capacity in water treatment chemicals at its Yanzhou location in China.

In June 2021, Kemira will be extending its production capabilities for these chemicals in Yanzhou, China. At the Yanzhou site, Kemira is putting up another sodium hypochlorite production unit. These investments represent an advancement in the company’s expansion plan and address the increasing demand for water treatment in China and Asia-Pacific markets, thereby contributing to the growth of the market share for water treatment chemicals.