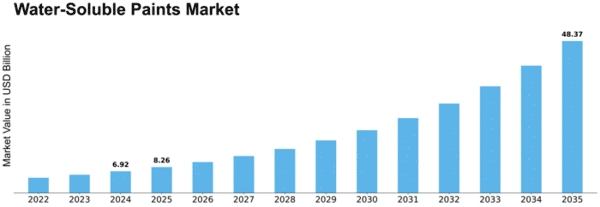

Water Soluble Paints Size

Water-Soluble Paints Market Growth Projections and Opportunities

The water-soluble paints market is influenced by various market factors that shape its growth and dynamics. These factors play a crucial role in determining the demand, supply, pricing, and overall competitiveness within the market. One of the key market factors impacting water-soluble paints is environmental regulations and consumer preferences. With increasing awareness about environmental sustainability, there is a growing demand for eco-friendly products, including paints. Water-soluble paints, being low in volatile organic compounds (VOCs) and non-toxic, are favored over traditional solvent-based paints, thus driving market growth.

Water-soluble paints are a relatively new class of paints, which use 80% water as a solvent in paints by volume. These paints use water-soluble resins, which are produced by polymerization or polycondensation in an organic medium.

Another significant market factor is technological advancements in paint formulations and manufacturing processes. Manufacturers are continually innovating to improve the performance, durability, and application properties of water-soluble paints. This includes developing new resin systems, additives, and pigments that enhance color retention, adhesion, and resistance to weathering and chemicals. These advancements not only widen the range of applications for water-soluble paints but also contribute to their increasing adoption across various end-user industries.

The construction and automotive sectors are major drivers of demand for water-soluble paints. In the construction industry, water-soluble paints are widely used for interior and exterior applications due to their ease of application, fast drying times, and low odor. Additionally, the growing trend towards green buildings and sustainable construction practices further boosts the demand for eco-friendly paints. In the automotive sector, water-soluble paints are preferred for their ability to meet stringent regulatory requirements, such as those related to emissions and worker safety, while still providing high-quality finishes and color options.

Market factors such as economic conditions and consumer spending also influence the demand for water-soluble paints. During periods of economic growth and rising disposable incomes, there is typically greater investment in construction and renovation projects, leading to increased demand for paints and coatings. Conversely, economic downturns may result in decreased construction activity and lower demand for paints. However, the relatively affordable pricing of water-soluble paints compared to alternative products can help sustain demand even during challenging economic conditions.

Globalization and international trade are also significant market factors for water-soluble paints. The expansion of manufacturing capabilities and supply chains across borders allows manufacturers to access new markets and cater to diverse customer needs. Additionally, trade agreements and tariffs impact the cost competitiveness of water-soluble paints in different regions, affecting market dynamics and pricing strategies.

Moreover, consumer preferences and trends play a crucial role in shaping the water-soluble paints market. As consumers become more conscious of health, safety, and environmental issues, they seek out products that align with their values. This includes choosing paints with low VOC emissions and eco-friendly formulations. Manufacturers and retailers respond to these preferences by offering a wider range of sustainable paint options and promoting their benefits through marketing campaigns and labeling initiatives.

Leave a Comment